By John Romeo

2026 has begun with a lot of noise — and a growing sense that the old maps no longer apply. We hear repeatedly these days that the last three decades are a poor guide to what comes next: that power matters more, spheres of influence are back in fashion, and rules can bend easily under pressure. Much of that is true. But while the headlines focus on geopolitics and hard power, a quieter shift is underway — one that is playing out not between states but within societies, organizations, and workplaces.

The forces that are changing the world and making the outlook more uncertain are also changing us. People around the globe have responded to these turbulent times by becoming more intentional, more values-driven, and more demanding, according to 300,000 Voices: What They Tell Us About The Next Era Of Global Change, a report that distills the findings of five years of global public surveys by the Oliver Wyman Forum. They are raising their expectations at precisely the moment when their trust in institutions has plummeted.

Healthcare has become proactive rather than episodic. Work is expected to deliver meaning, not just income. Leaders are judged less on vision and more on trust, empathy, and follow-through — in the everyday, not just at moments of crisis. While none of these shifts seem radical on their own, collectively they point to a deep rebalancing between organizations and individuals.

For leadership teams, the challenge is not to chase every new expectation but to make deliberate and explicit choices about where to invest in human outcomes rather than activity, where to trade scale for depth of trust, and where greater clarity is needed about what can — and cannot — be controlled. And there’s a critical overarching question to address: Where does the gap between how leaders believe they show up and how they are actually perceived create risk for trust and performance?

The next phase of leadership won’t be defined by how well organizations forecast the future, but by how confidently they navigate uncertainty alongside their employees and customers. That requires steadiness, clarity, and a willingness to listen — not just at moments of crisis but as a leadership discipline.

This month we explore the implications of changing attitudes for areas ranging from health to work to leadership itself. The findings may surprise some, but I’d wager those closest to their people already recognize many of them.

The message from the 300,000 voices is loud and clear: The future belongs to those who design for higher expectations — and meet them with authenticity.

John Romeo is CEO of the Oliver Wyman Forum

Today’s pace of change is exhilarating and exhausting. Events seem to come at us faster than our ability to make sense of them. Geopolitical conflicts, economic shocks, and rapid technological advances roil markets and societies in rapid succession even as the memory of the pandemic that disrupted the world lingers on.

How are people coping with these tumultuous times? By focusing more on things within their control and less on macro issues. They are devoting greater energy to deepening personal relationships, improving their physical and mental health, and achieving financial independence, according to 300,000 Voices: What They Tell Us About The Next Era Of Global Change, an Oliver Wyman Forum report based on 300,000 survey responses collected around the world over the past five years.

We value more but feel worse

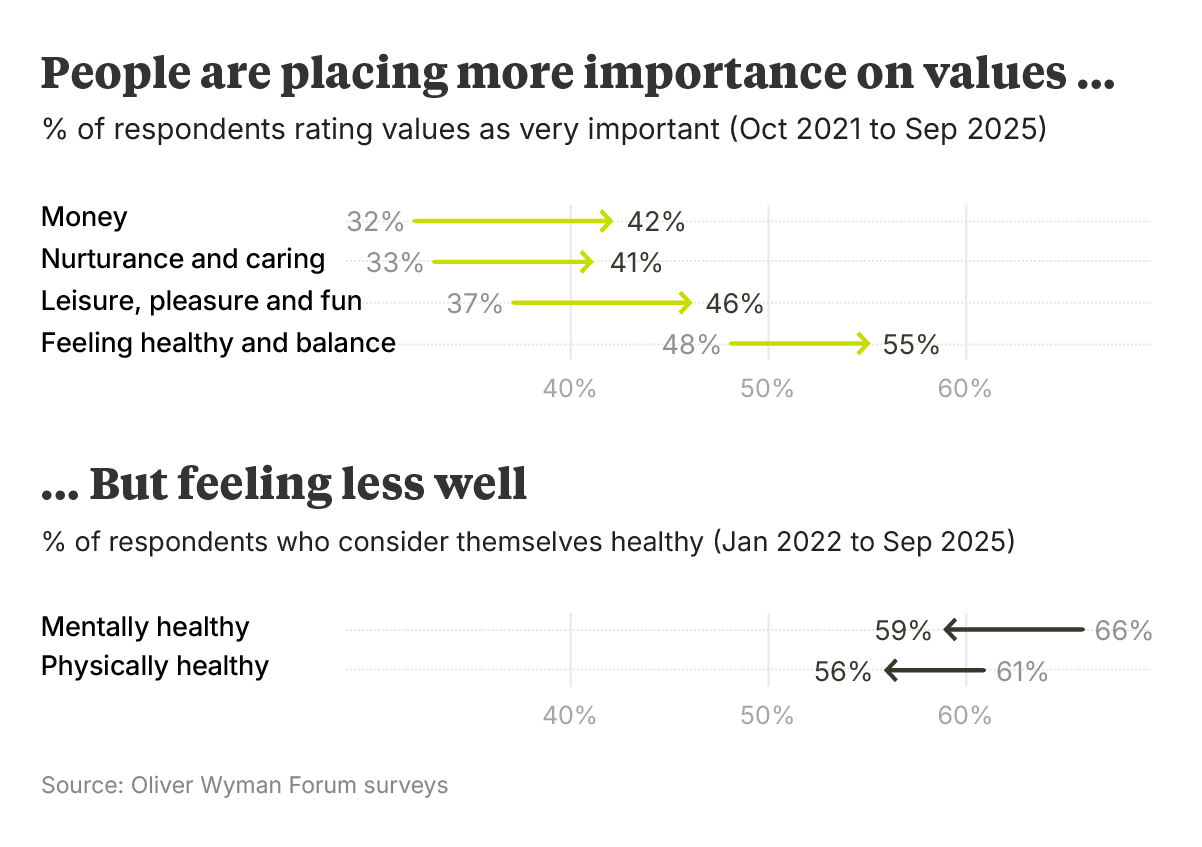

This pivot to the personal is a work in progress. People attach more importance to all 15 values we’ve tracked since 2021, ranging from achievement and success to connection and bonding to peace of mind. Yet these aspirations leave many feeling unsatisfied. Fewer people describe themselves as physically and mentally healthy compared with 2021, the share of people saying they feel pressure to make money has surged by more than 80%, and trust has migrated from big institutions to smaller groups of like-minded people.

The takeaway for business is clear: Organizations should design for higher expectations and narrower but deeper bonds of trust if they want to win greater engagement and loyalty from consumers and employees.

We track for health, community style

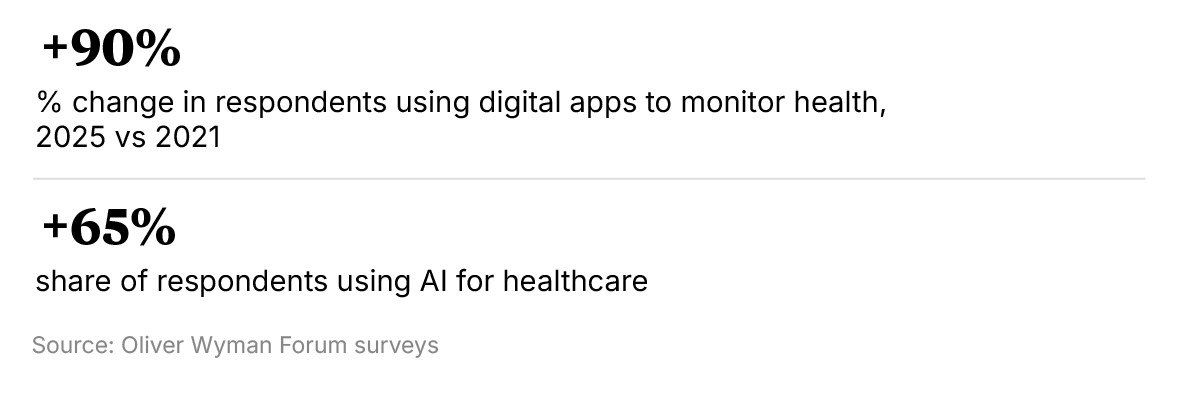

Healthcare exemplifies the broader changes in consumer attitudes, with self-care on the rise as people increasingly supplement clinicians with artificial intelligence and digital tools. The share of people practicing four or more wellness activities, such as working out, has increased by nearly a third since 2021, and their embrace of technology is booming. The use of apps for monitoring health data and food and water consumption has risen by three-quarters or more while a third more people are using fitness trackers. Yet people are less likely to consider themselves physically or mentally healthy today than four years ago.

The challenge for providers is to deliver measurable health outcomes, not merely engagement. And people expect technology and community to be part of the solution. Nearly two-thirds of respondents report using AI for healthcare, and more than half want better-tailored products and services. At the same time, the share of people who maintain health routines more consistently as members of a community has risen by nearly a fifth, to 61%, and the share encouraging family and friends to be healthier has nearly doubled, to 33%.

We want fulfillment in our work

In today’s uncertain labor market, workers are feeling more anxious and less inspired. They want more than just a paycheck — they want personal fulfillment from their jobs. Lack of fulfillment has jumped six places to second among people’s workplace complaints, trailing only pay — with just 26% of workers saying they are fulfilled by their work.

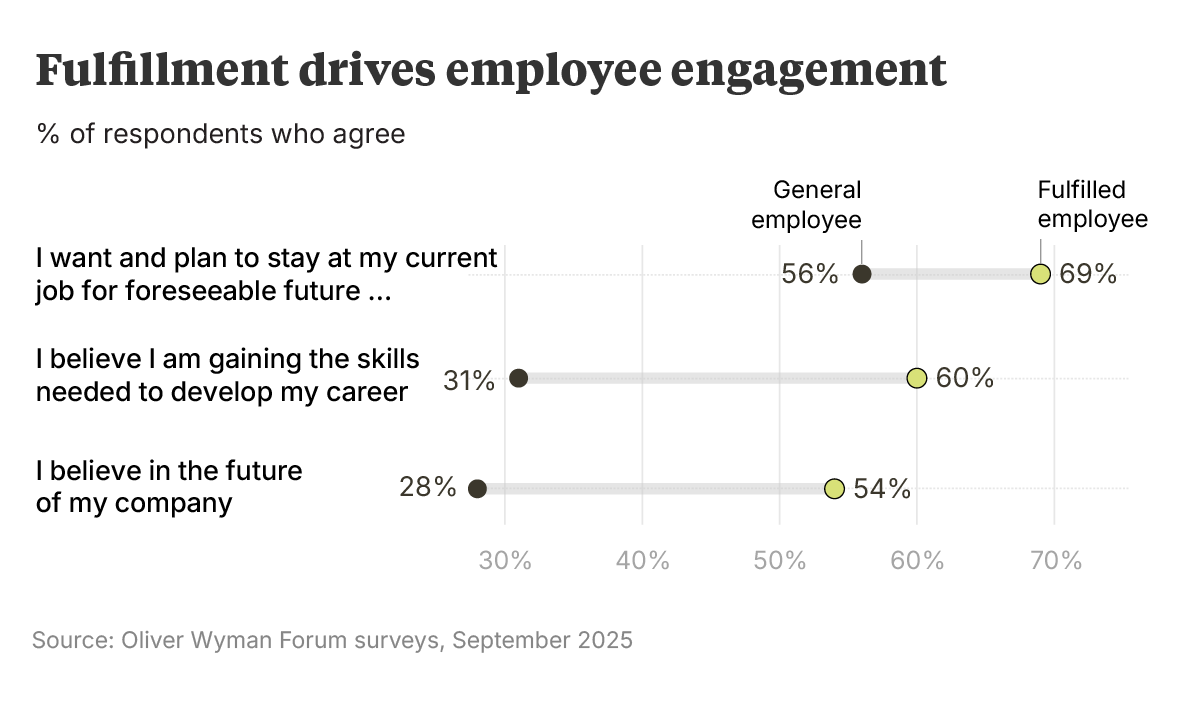

The big risk to employers is not that the unfulfilled leave, but that they stay and do just enough, acting as a drag on momentum and productivity. By contrast, fulfilled employees are twice as likely as the workforce at large to feel valued, and to believe they can gain needed skills and build a career at their company.

To foster greater fulfillment, employers can emphasize training and development. The share of employees who say training is the best way to improve their work experience has doubled to 32% since 2021, the fastest rise of any factor we track. It’s also notable that Gen Z has made the steepest gains in work satisfaction, manager relationships, and cultural fit of any generation — and reports the greatest productivity gains from AI.

We want proximity with authenticity from leaders

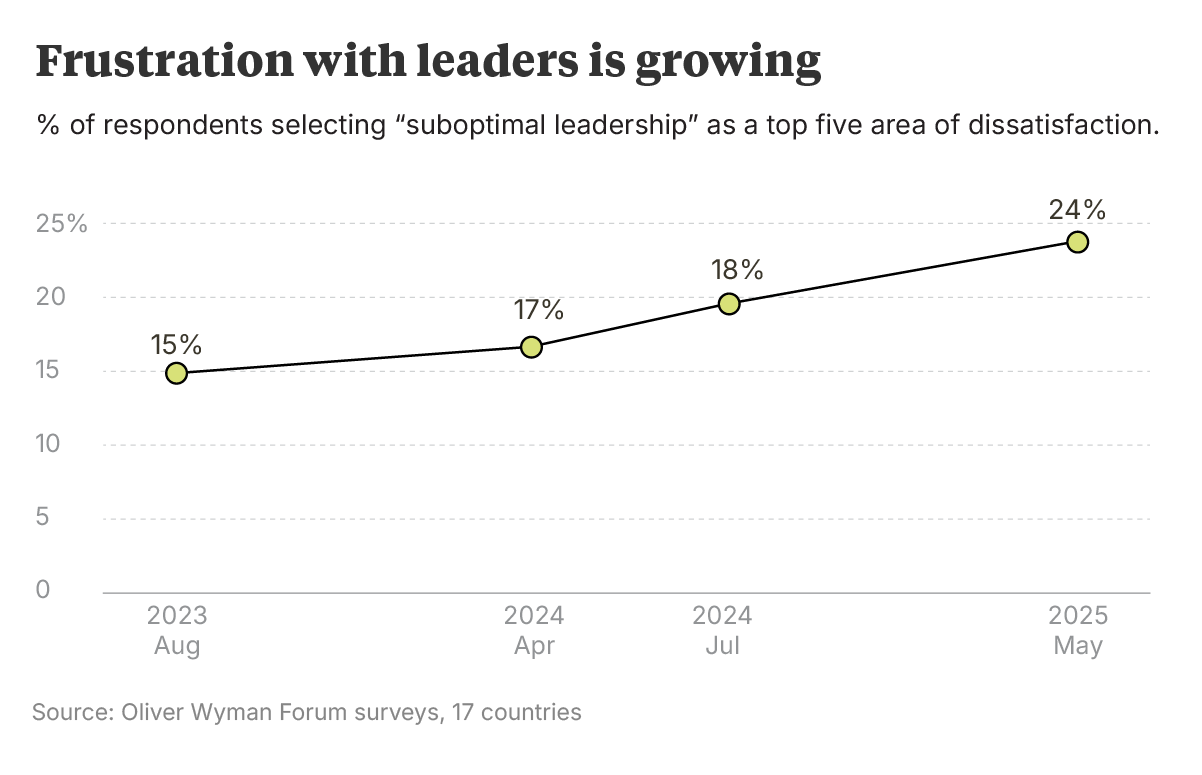

Today’s leaders have to navigate not just geopolitical and technological disruption but a more-demanding workforce with behaviors and expectations that vary across generations. Twenty-four percent of respondents expressed dissatisfaction with their leadership, up from 15% in 2023, and 51% believe their company’s leadership model is outdated, a view that’s far more common among Gen Zers than boomers.

One notable area of common ground is a desire for in-person interaction with leaders, which has surged by 75% since 2021. Employees want to feel genuinely seen, though, not fobbed off with scripted town halls. Call it proximity with authenticity.

It’s also instructive that a third of Gen Zers say they’d prefer an AI boss. That’s not a vote for a robot CEO but rather for traits they rarely see in humans: consistency, transparency, responsiveness, and fairness. This young cohort ranks emotional intelligence as the No. 2 trait they most value in a leader, and employees who see this in their leaders are five times more likely to feel satisfied with them.

Leaders can’t afford to be complacent on this score. While nearly three-quarters of executives surveyed in 2024 said their leaders had strong emotional intelligence, only 31% of non-managers shared that view.

The financial services industry is flourishing today, with shareholder returns and market valuations approaching post-crisis highs. But investors are clearly not pricing in the transformation that artificial intelligence or a more favorable global regulatory environment could unleash.

Investors may be skeptical that the good times will last in a historically cyclical industry. Or they may be wary that AI and other forces, such as geopolitics, private markets, or digital assets, could disrupt revenue streams, funding models, and client relationships for financial institutions.

To win them over, the industry will need to show it can harness these forces to strengthen the key drivers of value: earning power, operating margin, and capital efficiency, according to Oliver Wyman’s latest research, Known Unknowns for Financial Services in the Age of AI. The industry has a unique asset it can leverage to pull this off — trust.

Industry at the crossroads

Most financial institutions, and especially banks, are performing surprisingly well considering the challenges facing the industry before the pandemic. The end of the lower-for-longer rates cycle has boosted earnings power and valuations for a broad index of global banks constructed by Oliver Wyman, enabling them to deliver shareholder returns of 171% over the past five years, compared with 72% for the MSCI All Country World Index.

The industry now finds itself at a crossroads with investors, though. The fundamentals of the business are healthy and the economics of financial institutions could be transformed by new technologies and new regulatory approaches. Yet these same forces may attract new competition to the industry, and investors have not formed a clear view on whether they constitute opportunities or threats.

The report explores several of the key issues affecting the future of financial services:

The keys to winning in the Age of AI

Financial institutions have unique levels of trust with customers in identifying and understanding their needs, safeguarding their assets and data, and faithfully executing transactions as intended — or taking responsibility to correct mistakes. This is a powerful asset that should become only more so in a world dominated by AI platforms where identity, intent, and truth are uncertain. But financial institutions aren’t leveraging trust effectively in their journey into the Age of AI.

Their strategies thus far have focused on using AI to improve the efficiency of existing operating models and serving the growing ecosystem of AI-driven businesses — from hyperscalers to chip makers and data centers — as clients. There are challenges with both of those elements.

The true upside for financial institutions lies in business model transformation that draws on client trust built over decades. The critical transformation for financial institutions will occur at the client interface, not in the middle and back offices.

A selection of smart reads on business, technology, geopolitics, culture, and beyond.

- Companies Are Outlining Plans For 2026. Hiring Isn’t One Of Them. Large US employers are signaling they plan to keep payrolls steady in 2026 or reduce headcount, reflecting concerns about the economy and a belief that artificial intelligence could handle more work.

- Can AI Do Your Job? See The Results From Hundreds Of Tests. Researchers tested the ability of leading large language models to do real work assignments, such as redesigning an apartment. The results suggest fears of widespread job automation are premature.

- These Teenagers Are Already Running Their Own AI Companies. The latest tech craze has fueled the interest of young teens to start companies and their ability to do it through vibe coding.

- Why We Fall For Narcissistic Leaders, Starting In Grade School. Turbulent times provide fertile ground for narcissistic leaders, who exude confidence and strength, in business and politics. Wise leaders balance confidence with humility, not arrogance. We might get more of them if we factor humility in leadership contests, writes Adam Grant, organizational psychologist at the Wharton School of the University of Pennsylvania.

- Can We Save Wine From Wildfires? Wildfire smoke is changing the way grapes and wine taste. Some scientists are searching for a solution, while others are accepting smoke as simply part of a wine’s aeroir.

Every month, we highlight key data points drawn from more than four years of consumer research.