By John Romeo

The year end is a good time for reflection — not just on what has happened, but on the larger forces shaping what comes next. Many of those forces have been building quietly for more than a decade, but there is a growing sense we are living through a profound shift, moving from one order to the next, but without a clear view of what the new one will look like.

The last true inflection point came at the end of the Second World War, when the United States emerged as a global superpower and the geopolitical architecture and rules of engagement were rewritten.

Today, the old order has fractured before a new one has emerged. We are moving from one of the most peaceful periods in human history into a far more contested one. The United States now has a genuine peer competitor — a nation capable of matching its economic might, technological ambition, and geographical reach. The world is returning to spheres of influence, with the US and China defining the geometry of power and Europe uncomfortably caught in between.

What is certain is that geopolitics is no longer an exogenous shock to be handled; it must sit at the beginning of every strategic conversation, not be bolted on at the end. And whereas economics reigned supreme during the peak globalization years, politics now shapes markets in ways that are increasingly explicit, such as the new US National Security Strategy paper released earlier this month. Longstanding alliances are being reassessed, multilateralism is giving way to a worldview built around nation states, and economic, technological, and security considerations are being fused into a single strategic frame.

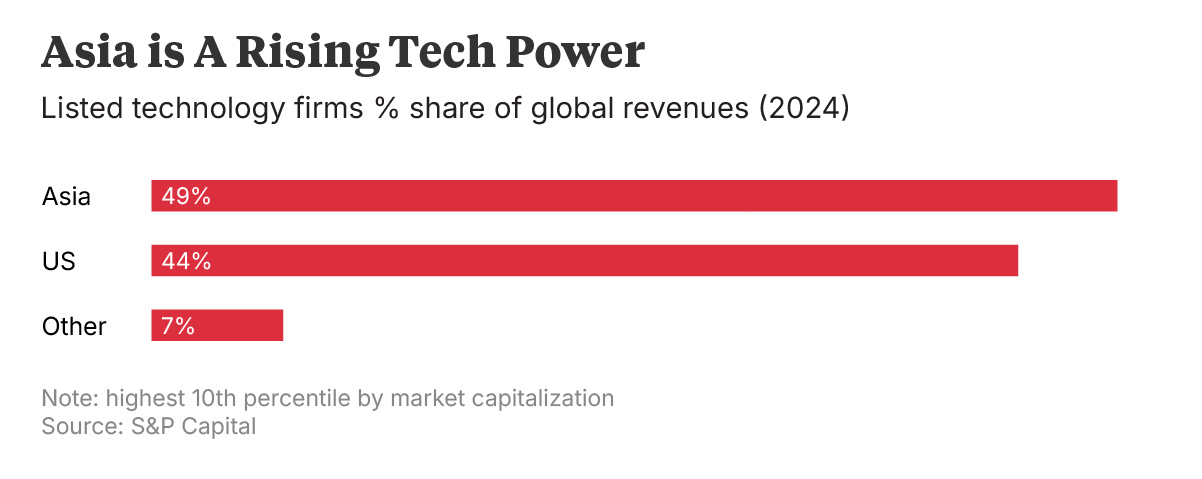

What will be the defining story of our time? My hunch is that historians ultimately will define this era by the extraordinary concentration of technological and economic power now taking shape. We could be heading into a world with a few trillionaires and a handful of companies more powerful than any nation except the United States and China.

As technology becomes the new strategic infrastructure, governments may eventually question how much irrelevance they are willing to tolerate. Will they seek to nationalize elements of this infrastructure? It sounds dramatic, but every technological inflection eventually forces states to reassert control, like they did with antitrust legislation in the early 20th century to rein in oil and railroad giants.

And yet amid all this flux, we shouldn’t lose sight of the opportunity. For the first time in history, we can augment human capabilities both physically and mentally. The risk-reward equation is being rewritten as forces once viewed separately — technology, geopolitics, demography, climate — now collide in real time. None of this is going away. The pace will not slow. The “firsts” will continue. And so will the black swans!

This is not a single moment to observe but a dynamic period of change to lead through. It is not a time to retreat or wait for perfect clarity; it’s a time to lean in and engage with the world as it is becoming. Progress has always belonged to those who step forward at moments of great uncertainty. The task now is to lead with clarity, with resilience, and with the confidence that our actions can shape the future.

Wishing you a joyful holiday season and success in the new year!

John Romeo is CEO of the Oliver Wyman Forum

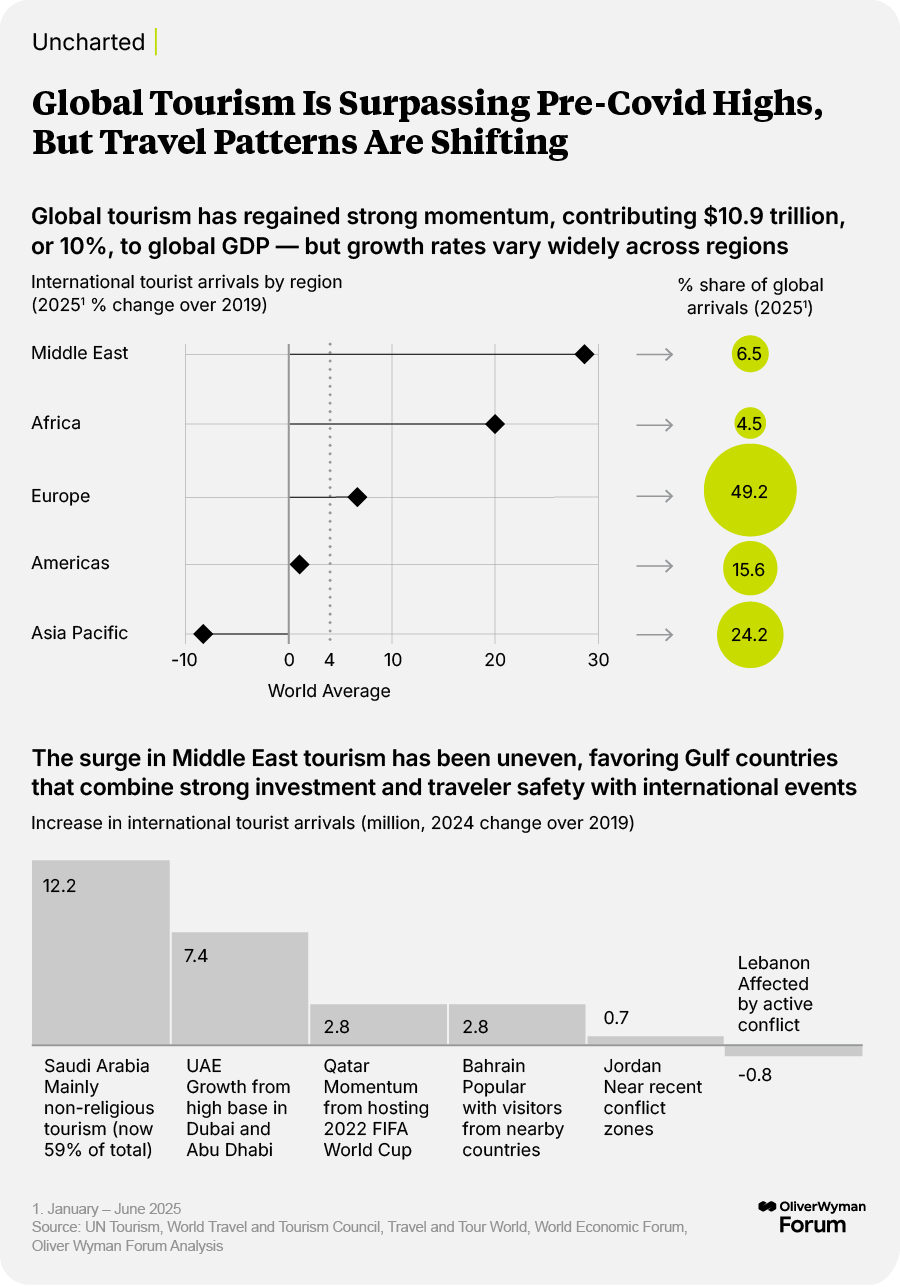

Asia continues to be the world’s economic engine, with growth running at an average of 4% a year — double or more the rate of the United States and Europe. But geopolitical tensions and a rebalancing of global supply chains demand that business and government adapt their strategies to rely on more than just China’s vast scale.

Innovation will play a key role in the region’s evolution by 2030, with knock-on effects on the global economy. The economic landscape will be transformed by technological advances in artificial intelligence, clean tech, and industrial robotics, according to Oliver Wyman Forum research and our conversations with senior executives and policymakers across the region. Companies also will have to adapt their products and workforce strategies for the region’s rapidly aging populations, while the continued expansion of incomes and mid-tier cities present new growth opportunities.

As companies continue diversifying supply chains to build resilience, activity will intensify around new trade and capital corridors. The largest links China and the countries of the Association of Southeast Asian Nations (ASEAN), and will see the former focus on advanced manufacturing while ASEAN countries and India move up the value-add ladder. Trade and investment flows also will accelerate between Asia and the Middle East.

De-risking for a geopolitical world

Companies are adjusting their footprints more broadly to reduce their exposure to China-US tensions. “It’s all about China plus five,” in the words of one major fashion brand executive. Few companies are exiting China entirely, but expanding supply networks across multiple countries increases resilience.

ASEAN countries and India are among the main scalable alternatives, with global export shares of roughly 8% and 2%, respectively. China-ASEAN trade already rivals that between Europe and the United States, and is forecast to grow 60% by 2030, to $1.4 trillion. US efforts to target Chinese transshipments create uncertainty, but 70% or more of ASEAN countries’ exports are expected to go to non-US markets by 2030.

Free-trade agreements and growing diplomatic activity, like the ASEAN, China, and Gulf Cooperation Council summit in Malaysia in early 2025, underscore the growing ties between Asia and the Middle East.

Upskilling to capture the power of AI

Artificial intelligence is the largest source of opportunity and uncertainty for Asian countries and companies. China, which shook up the world with the early 2025 launch of DeepSeek, is focusing on industry-specific applications to embed AI as a foundational layer of the economy. The country’s manufacturers could grow even more efficient, putting pressure on firms across the region to invest in productivity.

The need for greater employee training to capture the benefits of AI is a common theme among business leaders. That is especially the case for local companies constrained by their smaller scale and linguistically diverse markets. Many leaders expect governments to play a larger role here, which Singapore is doing under its National AI Strategy. AI infrastructure presents another opportunity, with Malaysia attracting $23 billion in investment for data centers in 2025.

New growth vectors at home and abroad

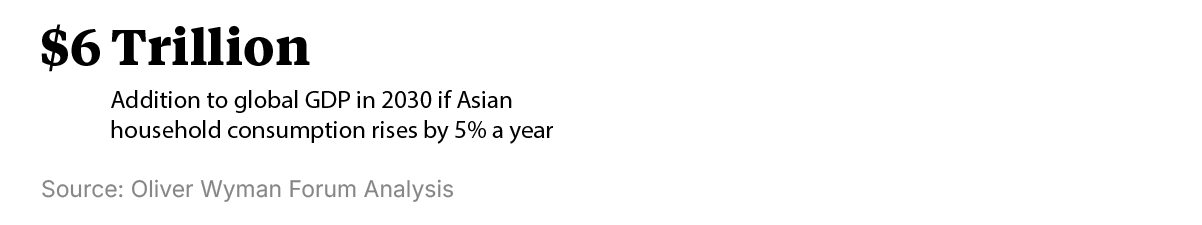

Rising incomes and the growth of mid-tier cities across the region present attractive opportunities to businesses that can adapt their models. If Asia’s household consumption rises at an average of 5% over the next five years, that would add roughly $6 trillion to global GDP. Chinese companies that have used rapid “test and learn” experiments to take advantage of shifting consumer tastes are teaming with foreign partners to export that model across the region.

As China continues to pivot to advanced manufacturing in sectors like electric vehicles and robotics, the rest of the region needs to shift from low-value final assembly to higher-value-added industries. That will require greater capital productivity and reform of capital markets to unlock new forms of financing.

Aging drives automation and new demand

The median age across China, Japan, and South Korea will reach 48 by 2030, compared with 44 in Western Europe and 40 in the United States. With executives already talking about labor shortages, aging is a major driver behind China’s push on automation and robotics.

Age profiles vary, though, and demand different business models. Executives in Singapore talk about designing products for the country’s older consumers while expanding their call centers in the Philippines, which has one of Asia’s youngest populations.

The so-called silver economy is a growing opportunity, with Asia’s over-60 population projected to reach 785 million by 2030. Airlines are targeting senior-friendly itineraries and automakers are designing vehicles with easier access. In finance, aging is expected to expand fee-based income from wealth management products, while insurers can expect rising demand for products offering flexible income streams and asset allocation, and include healthcare components.

Accelerating change and disruption is today’s norm, but Asian leaders are facing it head on. As one Singapore banker put it, “ASEAN has the agility and pragmatic policymaking to navigate the tensions.”

From political regime changes and ongoing conflicts, to tariff wars and truces, to the pas de deux between hope and fear around artificial intelligence, the pace of change and swings in sentiment during the past year have been dizzying.

Yet there is signal in the noise, much of which is captured in the Oliver Wyman Forum’s most-read pieces of 2025. We started the year with a review of the changes that define the state of our world, ranging from the need for business leaders to adopt a geopolitics-first mindset to the secrets of reaching increasingly fickle consumers. Those issues look evergreen as we head into a new year.

We also took the pulse of CEOs in the United States and Europe, revealed how leading companies are generating significant return on investment with AI, explored a new model for defining economic progress, examined how women’s representation can boost growth, and identified hundreds of cities driving growth and innovation around the world.

The Year In Review

Here are the top 10 most-read articles published by the Oliver Wyman Forum in 2025:

A selection of smart reads on business, technology, geopolitics, culture, and beyond.

- The Case That AI Is Thinking. ChatGPT does not have an inner life. Yet it seems to know what it’s talking about.

- The Math Legend Who Just Left Academia For An AI Startup Run By A 24-Year-Old. Ken Ono, a University of Virginia professor and mathematics legend, was skeptical AI had the creativity to shake up the field —– until a recent test of models produced an epiphany and persuaded him to join a former student’s startup.

- China’s Manufacturing Is Booming Despite Tariffs. U.S. pressure has only cemented its rival’s status as the world’s indispensable factory floor, sending its trade surplus above $1 trillion.

- How Much Abuse Can America’s Allies Take? The new US National Security Strategy suggests that belligerence and explicit quid pro quos are likely to be a core part of the country’s foreign policy going forward, not an aberration.

- “Who Was The Foodie?” The popularization of foodie culture has turned what we eat into a vehicle for personal enjoyment and aesthetic virtue-signaling, according to writer Alicia Kennedy. She urges a return to the culture’s 1960s roots of focusing on where our food comes from and how it’s produced.

Every month, we highlight key data points drawn from more than four years of consumer research.