Money is about to undergo fundamental changes in the way it is created and used, potentially unleashing a dramatic reordering of the financial system. While volatility has shaken cryptocurrency markets over the past year and caused a string of failures, many parts of the digital asset ecosystem continue to advance largely unaffected by the turmoil, as we explored in an earlier paper. These include the areas with the greatest long-term potential to transform finance, including the tokenization of financial assets and deposits and the development of central bank digital currencies (CBDCs) by most of the world’s largest economies. The rise of digital assets and distributed ledger technology (DLT) continues to have the potential to upend the competitive landscape, creating new, efficient, nimble competitors, but also offering incumbents a potential new lease on life. Executives and policymakers need to stay focused on the opportunities and risks associated with digital assets.

The future of digital assets as a whole depends heavily on the future of digital money, as payments power the financial system. However, digital money could evolve in quite different ways; for example, there are different forms of digital money that could form the basis of new approaches, spanning CBDCs, tokenized deposits and different types of stablecoins. Executives and policymakers must think in terms of multiple scenarios rather than relying on a single prediction. These approaches will transform business models as they favor different types of issuers and their adoption will reshape liquidity, market-making, and risk management, which could impact the broader financial system considerably.

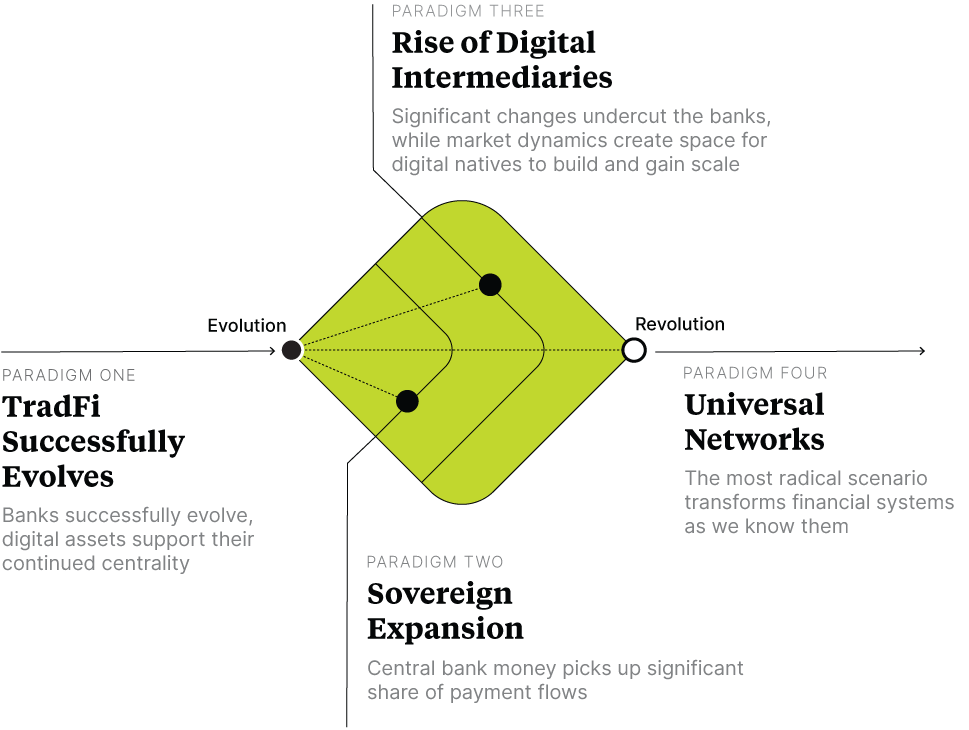

To help industry executives and policymakers frame their thinking, this report presents four paradigms based on the issuers of money, the technology they choose, and the use cases they target. Traditional financial institutions could successfully evolve or be challenged by the rise of digital intermediaries. Alternatively, universal networks could transform financial markets and business models, or sovereigns could expand their control of money and change the role for the private sector and its business models.

In a world of significantly higher interest rates, the economic value generated from facilitating payments could be bigger and even more contested. Establishing valuable commercial propositions will be crucial to scaling different forms of digital money. Their viability, in turn, will depend on the policy landscape, technological innovations, and the infrastructure design choices that money issuers make. Each factor will play a role in determining the winners.

Policymakers and senior leaders in the financial industry, both incumbents and disruptors, should consider a range of plausible future scenarios, evaluate their potential impact, plan responses for the most likely developments, and consider how to bring about the most desirable outcomes. This process may play out quite differently across cross-border payments, asset settlement, and retail domestic payments. We will follow up in coming months with papers that focus on these specific digital money use cases.

Technology has transformed the way we think about and use money from the first electronic payments in the telegraph era to the rise of mobile payments and cryptocurrencies. Today that process is poised to accelerate dramatically. Distributed ledger technology (DLT), such as blockchain, is inspiring the creation of new forms of money, from central bank digital currencies and tokenized deposits to stablecoins. These digital monies have the potential to make payments faster, cheaper, and more secure, and enable new economic activity and business models.

This transformation of money will both fuel and be driven by a broader transformation of the financial system. DLT is enabling the creation of a broad array of assets, from digitized versions of traditional financial instruments such as stock and bonds and historically illiquid assets like art, real estate, and intellectual property, to digitally native vehicles that offer novel ways to transfer value. These assets can attract participation by a wider range of entities and investors, as well as change how they participate, fostering the rise of new financial products and business models.

Digital assets and technology also will change the shape of financial services and markets. By presenting transactional and ownership information on a single, shared ledger, DLT enables participants to transact with one another without the involvement of traditional financial intermediaries. It enables the automation and coordination of transaction processes among multiple stakeholders, which will change the cost and distribution of financial products. This could spur new private networks that displace existing intermediaries and allow greater automation and integration across borders and asset classes. Alternatively, it could create new opportunities for banks, exchanges, custodians, and other institutions that embrace DLT and adapt their business models.

Money is at the heart of these innovations. A thriving digital assets market requires a seamless way to trade these assets. A digitally native solution that embeds money in the same distributed framework as the assets themselves will maximize the speed and cost-effectiveness of payments, as well the connectivity to associated services such as collateral management and yield enhancement. Of course, such a solution needs to be trusted, reliable, sustainable, and secure.

While digital assets have the potential to transform the way we store and exchange value, their success ultimately depends on whether they can be integrated with the existing financial system. Such an integration has the potential to enable faster and more secure transactions across the financial system. Payments could be settled instantly and safely, at any time of day, and at the same time assets are exchanged, a process known as atomic settlement. The financial system could change significantly as digital money impacts liquidity, market-making, and risk management given its speed and automation.

Establishing valuable commercial propositions will be key to scaling up digital money, but the viability of those propositions will depend heavily on the policy landscape and technological innovations. Capital and liquidity requirements will have a major impact on the feasibility of commercial propositions, while the integration of digital money across borders can create the critical mass to power new business models. But both of those elements require a coordinated approach by national regulators, which is still in an early phase. At the same time, advances in technology will drive whether platforms can handle the volume of activity needed. New platforms also face the classic chicken-and-egg problem: how to start attracting consumers and producers when the economic value generated by facilitating payments to participants depends on high transaction volume.

Key players are making critical investments and strategic decisions now that will shape the future. In a world of significantly higher interest rates, the economic value generated by facilitating payments could be bigger and even more contested. Executives need to start preparing for the ways in which digital money can transform the competitive landscape in which they operate. We present four paradigms to paint the corners for how this transformation might play out. The future of money will likely combine a mix of these different paradigms, and in potentially different proportions across various sectors and use cases. Industry leaders should prepare for the future by considering the full range of plausible scenarios.

The future of money isn't preordained. A vast number of market participants are working to reshape that future. Blockchain and digital native startups are developing innovative products and services that have the potential to disrupt traditional financial systems. Incumbent institutions like banks are investing in new products, such as digital asset custody and settlement solutions. Fintech firms are already making significant inroads in transforming the way money moves globally. Big tech firms are also exploring the potential for their own digital currencies and payment systems, leveraging their massive user bases and data analytics capabilities. Central banks are researching the potential for digital currencies to complement traditional ones. Finally, regulators will play a critical role in shaping which commercial propositions are both viable and safe.

The future of money and payments can take radically different directions depending on the forms of money that gain scale, the technology designs issuers choose and use cases they target, how incentives are incorporated, and whether the regulatory and policy environment is favorable, among other factors.

Changes to money itself can have a profound impact on the financial system at large. To help industry executives and policymakers frame their thinking, we introduce four paradigms based on the types of institutions that could produce solutions that scale. These paradigms are meant to support scenario planning and are likely to coexist. They are not comprehensive and do not cover every possibility, such as a future in which cryptocurrencies like Bitcoin become a major part of the payments system.

This paradigm represents an evolution of the existing system, not a revolution, as banks and other incumbent financial institutions continue to dominate. (We will generally say “banks” for short.) It assumes that banks largely evolve successfully, with digital money supporting their continued centrality to the financial system.

For this paradigm to take hold, financial institutions need to demonstrate the commercial value of digital assets. Experimentation will lead to viable business models as banks become leading enablers for the new technologies, tokenizing both money and assets. Momentum could grow as solutions cascade across the system, from core activities like asset issuance and treasury to areas like merchant solutions and payments. Policymakers will be key enablers, providing regulatory space for innovation and potentially pushing new networks that reinforce banks’ position. This paradigm also will become more likely if regulation slows down digital natives or puts limits on potential commercial models.

If banks can evolve successfully, they would thrive by ensuring their key economic and intermediation roles, pursuing new opportunities while providing balance sheet to support trading and lending activities in new infrastructures that lower their cost bases. Modernization of payments and trading could drive major efficiencies for clients by reducing liquidity needs, which would impact banking costs and revenues. This could increase market concentration as smaller players are squeezed out by margin pressure as well as the cost of adopting new infrastructure and the fight for talent. Even as banks evolve, institutions would continue to face strong competition for client relationships, including from big tech.

In this paradigm, central banks would provide retail or wholesale users with CBDCs and use their instantaneous settlement capabilities to pick up a significant share of payment flows. Although central banks considering CBDCs are currently aiming to play a core role in payments without greatly disturbing the existing financial system, this paradigm assumes the process goes much further than current plans and does indeed transform the system.

Radical change in the role of the central bank would require societal support. Individuals could come to prefer the features provided by retail CBDCs. Alternatively, demand could be driven by investors and institutions who want to ensure their digital money is fully backstopped by the central bank. This diversion of payment flows from private money to public could have a significant impact on bank business models, which would have to rely more on equity and wholesale funding rather than deposits.

While the role of the private sector in money issuance might decrease, central banks might continue to partner with the private sector to distribute and maintain access to money. This could mean new opportunities and fee-based business models focused on the distribution and allocation of public money. Banks could find themselves in tough competition with payment service providers or new digital intermediaries. There could be an increased role for technology companies in providing payment services and infrastructure, as central bank money is integrated into mainstream payment systems.

With public money having a greater role in the economy, central banks may then have more tools to enact and control monetary supply, as well as more real-time data. This paradigm could lead to greater financial stability as central banks gain more visibility and control over the money supply, but also create the potential for unintended consequences and new risks to emerge. Financial institutions would need to adjust their business models to account for the change in payment flows, particularly in terms of their balance sheets and funding models.

This paradigm sits somewhere between evolution and revolution, with digital natives gaining scale as the traditional financial industry struggles to adapt. Banking could be squeezed, with digital natives controlling customer access and expanding financial services provided.

This paradigm can take shape if digital assets gain scale with intermediaries carving out key areas for differentiation. This could include a trusted digital money solution, with stablecoin issuers gaining scale, or efficient and compliant market infrastructure solutions, such as cryptocurrency exchanges concentrating liquidity. To capture institutional flow, digital intermediaries will need regulatory acceptance of their business models. Profitability of digital natives would enable them to launch compelling new services across financial services, including lending, origination, and liquidity provision, while traditional finance players work to overcome legacy technology, culture, and regulatory obstacles. Integration across services could be established through cooperation across the value chain, or itself become a way for new digital intermediaries to emerge that provide the range of services.

Powerful new companies could emerge that operate globally and squeeze other financial institutions out of client relationships, potentially starting with younger, early adopters. As a result, competition between financial services providers would start to move from control of operating accounts to custody, as money increasingly moves into stablecoins held in digital wallets. This suggests banks and financial market infrastructure firms would be hit by multiple pressures, including loss of business, pressure to pivot business models, and costs to accelerate digital asset capabilities. Beyond banks, competition between digital natives could also accelerate and would likely include the entry of big tech players. Smaller proprietary networks might push for interoperability to ensure continued relevance.

This is the most radical paradigm, one that would strongly transform the financial system. The rise of new open networks would enable borrowers and lenders, issuers and investors, and other market participants to deal directly, without intermediaries. Transactions would be powered and governed by smart contracts and institutional decentralized finance protocols. The trend toward capital market-based financing would be accelerated by algorithmic creation and allocation of credit over highly integrated networks. This could disrupt the business models of banks and today's digital natives.

Radical change would require high levels of support. Policymakers could become more comfortable with this paradigm if there are trusted solutions to compliance and safeguards in existing networks. Alternatively, supranational organizations could enable cross-country collaboration for new platforms, such as the Bank for International Settlements’ (BIS) vision for a unified global ledger or the International Monetary Fund’s (IMF) proposal for a multi-currency marketplace. It’s also possible that trust is built over time through experimentation with new policy tools. The European Commission, for example, put out a tender for a study on embedded supervision of decentralized finance. Networks that are truly universal will also depend on convergence around shared standards, as well as continued advances in technology that enable both scale and trust.

This paradigm would imply greater participation and expansion of capital markets, but participation models could change dramatically as users and investors are connected by automation instead of intermediaries. This would require financial services providers (or new types of organizations) making using of automation to also expand risk management capabilities and successfully build incentive models. If users can control their data and wallets, that could encourage new services that blur the lines between banking and commerce, enabling financial activities to become embedded and seamless. With the growth and expansion of market-based financing, investors and firms alike would need to become more sophisticated about risk management.

Participants are already planting the seeds of these various paradigms. Policymakers are taking decisions and companies are exploring commercial propositions that will determine which forms of money are viable. The networks where digital money is issued and gains scale will define who is in the running to offer new services. These seeds won’t sprout overnight but senior executives need to start preparing now. Money has network effects and digital money could scale at a rapid pace.

Competing forms of money will feature different business models and economics for their issuers and will need to win the trust of users that nominal value can be maintained. Generally, issuers make a profit by earning an interest margin on the assets backing the money and by collecting fees on payments, transactions, and bundled services, while ensuring trust by appropriately backing the issuance. In a world of higher interest rates, the economic value generated from facilitating payments becomes more attractive.

Central bank digital currencies are a digital form of central bank liability.

Many central banks are exploring CBDCs to ensure the money they issue continues as an anchor of value in an increasingly digital world. A retail CBDC would serve as a modern version of paper currency or coins: made available to all individuals but digitally native and more similar in experience to a bank account, with similar levels of data access by authorities. Several major economies are expected to launch retail CBDCs within the next five years, including China (which has been working on a digital yuan project since 2014), India, and the European Union. An expansive retail CBDC could divert deposits from the banking system, increase bank funding costs, and reduce bank interest income, which explains why many banks oppose the idea. Some central banks are looking to cap the amount an individual or firm may hold in CBDCs and ensure they seamlessly integrate with deposits, which could favor banks. On the other hand, CBDCs might create new fee-based income opportunities for payment service providers that partner in distribution, favoring new digital intermediaries.

A wholesale CBDC is a modern version of reserves issued on new central bank platforms to help financial institutions, not consumers, transact more efficiently with each other. Countries are exploring them mainly for cross-border payments and to settle asset transactions. By speeding up wholesale payments, they would reduce the need for banks and corporations to tie up liquidity for two or more days. A wholesale CBDC would retain the two-tier structure of today’s financial system, whereby central bank money underpins private money creation by commercial banks and others. The paradigm it favors will depend on which types of institutions have access to wholesale CBDCs.

Tokenized deposits are a digital form of a bank deposit issued by a regulated institution.

They are recorded on a distributed ledger and intended to settle trades of tokenized real-world assets or other digital assets. Tokenized deposits could take on different forms, whether account or token-based. Financial institutions and central banks have only recently begun experimenting with these instruments, and many issues remain to be resolved in both regulation and business models. For example, from a regulatory perspective, it’s not clear how capital and liquidity requirements might need to evolve if tokenized deposits lead to different behaviors and usage. It’s also not clear how deposits from different institutions will be made interchangeable and whether new business models will emerge to solve for that.

Issuing tokenized deposits would favor banks’ economic position by helping to secure their funding, which has traditionally relied on customer deposits, and providing a currency for participating in the digital asset sector. This could be a key driver for traditional finance to evolve successfully.

Fiat-backed stablecoins digital assets designed to maintain a stable value against a national currency, such as the US dollar, backed by assets denominated in that currency.

These instruments play a major role in crypto markets, with more than $7 trillion in transactions executed in 2022, and issuers are exploring their use for real-world payments. Most stablecoins do not pay interest, unlike deposits, which can provide significant value to issuers in a rising interest rate environment. They also generate fee income from transaction and treasury services that scale up with volume growth. Digital natives dominate the stablecoin market and they could develop powerful new intermediary roles as the use of these coins proliferates. Financial institutions have recently begun to issue their own stablecoins.

Stablecoin growth will require coherent regulation, and potentially adjustments to existing business models. Maintaining a peg against the dollar or other currency depends both on appropriate reserves to manage normal outflows as well as access to backstops in the case of systemic events. The importance of maintaining a peg was highlighted by recent contagion events in the wake of the Silicon Valley Bank collapse, where concerns around traditional finance deposits spread to crypto markets. Stablecoin regulation has evolved at a different rate across the globe. For example, the European Union’s new Markets in Crypto-assets (MiCA) regulation mandates that issuers hold reserves to back their coins; however, the United States might take years to develop comparable rules, given the need for legislation from a divided Congress.

Decentralized stablecoins are private sector-issued digital assets designed to maintain a stable value while backed by other digital assets.

These represent a small fraction of total stablecoin transactions and their regulatory path is not as clear as fiat-backed stablecoins, especially given their reliance on decentralized governance. After the Terra/Luna collapse of 2022, coins relying on algorithms to maintain a peg have lost favor to designs based on overcollateralization. These stablecoins generate interest income from overcollateralized reserves, as well as fees from executing trades and collateral liquidation from margin calls.

While a small fraction of current market activity, decentralized stablecoins could represent the frontier of innovation, making use of smart contracts and new governance designs to manage their balance sheets and distribute the economic value from issuance.

These options are not exhaustive. The ease of swapping different digital assets through smart contracts means a wider variety of tokens can function like money to exchange value in a transaction. This can blur the lines between money and assets, enabling new business models while also creating new policy challenges. For example, funds kept with traditional money market funds need to be withdrawn to be used in payments, but this could change if money market fund tokens are recognized as means of payment in smart contracts or networks.

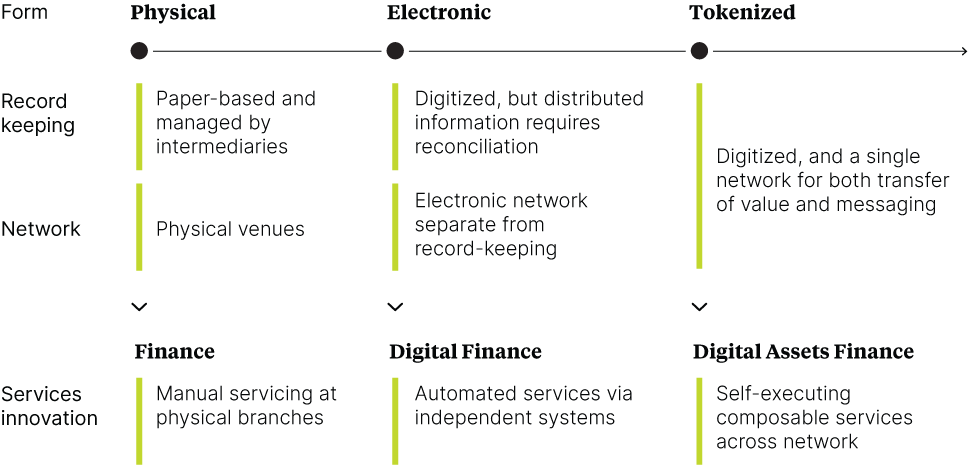

Market infrastructure design and participation is becoming a key strategic and policy issue. In the traditional financial system, money and assets exist on separate networks, where banks have a privileged role in helping settle transactions. DLT-inspired technologies could upend this system and disintermediate banks. The more integrated and universal the network – that is, the greater diversity of assets and stakeholders that a distributed network contains – the higher the likelihood that new business models could emerge and disrupt banks.

Because there are significant network benefits with digital money and assets, market infrastructures that are early in gaining scale might later be hard to disrupt. A variety of network designs have emerged, ranging from open, permissionless networks that defy national borders to tightly controlled ones, each one with different economics. Senior executives should understand the motivation, opportunities, and challenges for each design.

Closed (permissioned) networks impose limitations on who can access and manage the network. Financial institutions have used this option in digital asset experiments because it aligns closely with their existing business model as regulated providers of financial services. It also has greater policy support given the greater level of control and the ability to rely on existing approaches to manage risk and compliance. For example, the BIS advocates this approach in its vision of a unified global ledger.

This type of network could be the least disruptive to the financial industry, while also leading to a reshuffling within the industry if some banks are slow to adapt. However, if only a few banks and participants join, it could make it harder for any network to scale up and develop a rich digital assets ecosystem.

By contrast, in open (permissionless) networks, participation is limited only by economic realities. This is the approach used by most crypto networks today. Given the challenges with enforcing compliance and regulation when there are no restrictions on access and usage, many in the industry are looking to build a “trust layer” to ensure transactions take place only among verified participants. Banks that have issued digital bonds and stablecoins on public networks have followed this approach. Project Guardian by the Monetary Authority of Singapore (MAS) was an example of experimentation by the public sector. As discussed in our paper on the project, broader industry efforts are needed to scale this solution, including the creation of legal clarity, standards, and guardrails. A trust layer could enable digital natives to launch innovative new services in lending, origination, and financing in a manner that gains policy support.

The future of money is highly unlikely to be monochrome, with every sector adopting the same instruments, technology designs, and business models. Instead, it will grow use case by use case, driven by preferences and decisions made across business segments and geographies. The future will likely combine elements of some or all of the four paradigms. Here, we look at how these factors might play out among some of the most likely competitors across three major use cases – cross-border payments, asset settlement, and domestic retail payments.

Sending money from one country to another can be a costly and prolonged process. Our joint paper showed that corporates move more than $23 trillion across borders each year and incur roughly $120 billion in transaction costs. A common digital platform linking national CBDCs to enable real-time, 24/7 cross-border payments could slash corporate transaction costs by more than 80%, or $100 billion a year.

Over 30 countries have already started experimenting with using CBDCs for cross-border payments. In a pilot project with the BIS, the central banks of China, Hong Kong, Thailand, and the United Arab Emirates showed that digital ledger technology could execute trades between the four parties’ digital currencies in seconds and reduce costs as much as 50% by cutting out correspondent banks and streamlining liquidity management. Meanwhile, new market infrastructures and business models are emerging. Banks have launched consortia that use blockchain technology for multi-currency FX net settlement and for payment-versus-payment capability. New stablecoins are emerging pegged to new currencies, with MiCA providing regulatory clarity for euro-pegged stablecoins. The cross-border opportunity is vast but the challenge facing all innovators is the need for coordination, harmonization, and interoperability between so many jurisdictions and technology platforms.

Traditional asset settlement, while largely electronic, is still costly, time-consuming, and complicated. Processes are fragmented by asset classes and jurisdictions, with limited standardization. Digital money could introduce some greater efficiencies, but it would require the widespread tokenization of a range of assets to reap the full benefits of settling trades in CBDCs or stablecoins or tokenized deposits. We are far from that point, with total digital bond issuance amounting to just $1.5 billion currently, a tiny fraction of the $127 trillion global fixed-income market.

Digital payment solutions could enable a variety of technology firms to compete with global custodians that have traditionally dominated this space. Institutional DeFi protocols can automate financial transactions and provide a more decentralized and secure way of settling assets and automating risk-management practices. Real-time settlement based on delivery versus payment can reduce the risk of counterparty default and free up capital for other purposes. Banks, custodians, and other traditional intermediaries will need to adapt quickly to harness these changes. Estimates on the expected size of tokenized asset markets vary widely, but there could be reinforcing benefits to redesigning both asset forms and the money that’s used to settle transactions, which would accelerate the rate of change.

Central bank digital currencies will be a big wild card in retail payments, with roughly 100 jurisdictions around the world exploring the issuance of CBDCs or having already done so. Few CBDC projects make use of DLT, while many leave the development of new payment features to the private sector. This could unleash competition between the firms that dominate payments today and blockchain-native innovators offering new value-added services based on programmable smart contracts or loyalty features like rewards programs. Stablecoin issuers are already looking to apply their technology to real-world retail payments. Open infrastructures that allow users to exercise more control over their data, an integral part of web3 ecosystems, could gain favor with consumers.

The paradigms presented in this paper can help banks, businesses, and policymakers as they consider their next steps, but they aren’t mutually exclusive. We are likely to see some if not all of these types of money coexist and play a growing role, depending on whether they are being used for retail transactions at the corner store or to finance multi-billion-dollar cross-border trade deals or investments. In subsequent papers, we will explore these different use cases in much more detail, and we will examine how the paradigms could play out under different scenarios and what industry leaders should be doing today.