The collapse of FTX in November 2022 put a capstone on a terrible year of failures and lost market value in the world of digital assets. Did this prove that the whole crypto boom was just a speculative bubble or even a scam? Can serious people in finance now disregard the sector?

The short answer is no – and that’s a good thing. Many parts of the sector show real promise for useful innovations to provide more efficient and effective financial products and services for businesses and consumers. The calamities of the past year revealed major flaws in the business models and practices of many crypto ventures, notably in the exchange and lending spaces, but they did not reflect fundamental weaknesses in the industry’s underlying technology or its ability to transform many areas of financial services.

The challenge ahead – for digital asset businesses, investors, developers, policymakers, and consumers – is to focus on that promise, identify and rectify the flaws, and develop rules of the road (both formal and informal) that offer protections for investors and users while fostering truly valuable innovation.

Read the Paper

How will that play out in 2023 and beyond? We expect innovation will continue in most areas of the digital asset ecosystem. There is strong potential for growth in stablecoins for use in real- world payments, especially if regulators set rules for the reserve backing of these coins, as officials around the globe are starting to do. Governments are stepping up their exploration and development of central bank digital currencies, or CBDCs. Banks are increasingly looking to tokenize deposits to provide faster and cheaper payments, and to tokenize traditional financial assets to reap major efficiencies in clearing and settling transactions. Decentralized finance, or DeFi, shows promise to transform capital markets more broadly if the right safeguards are applied, as we explained in a recent joint paper.

At the same time, the past year’s events highlighted the need for reform in some sectors such as exchanges and lending. We expect regulators in many countries will put in place a range of new investor protection requirements to prevent further blow-ups like the failures of FTX and crypto lenders like BlockFi, Celsius Network, and Voyager Digital.

Crypto markets also need a good dose of self-help. The culture of digital asset firms and stakeholders must evolve for the sector to prosper safely. Firms also need to cooperate more actively with each other and regulators to develop the common standards and frameworks that are critical for digital assets activities to achieve real scale.

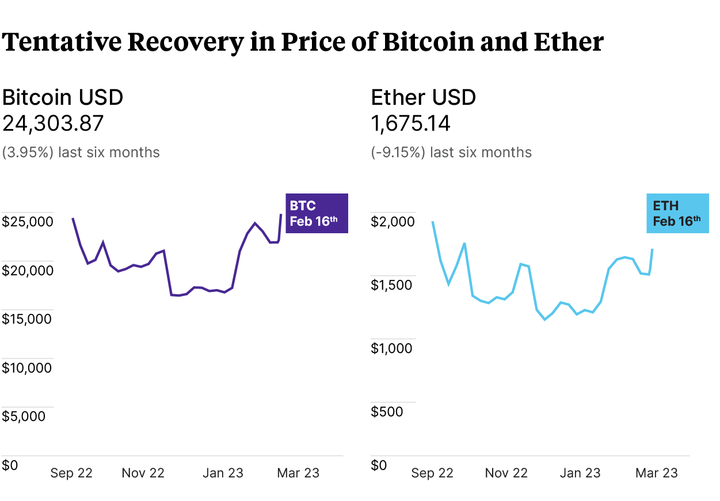

Investment and speculation in cryptoassets took a big hit during the recent crypto winter but investment will not vanish, judging by the 40% rebound in the crypto market’s capitalization in 2023, as of Feb. 16.

A Dramatic and Difficult Year

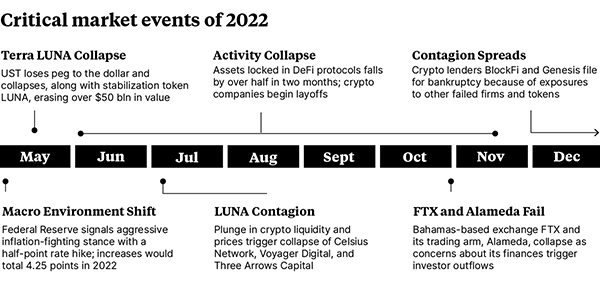

2022 brought a series of damaging events for some significant parts of the digital assets sector, as shown in Figure 1. Cryptoasset prices peaked in November 2021 and fell by roughly two-thirds, or $2 trillion, over the course of 2022. This price decline, and the corresponding reduction in activity and investor/speculator interest, is often referred to as a “crypto winter”. May of last year saw the collapse of the TerraUSD algorithmic stablecoin and its companion token, Luna, as well as the bankruptcy of firms that were offering high-yield products that many customers assumed were as safe as bank deposits. These firms were in fact doing versions of repo of digital assets, often with exotic/unproven collateral, a business model that blew up when asset values fell. In November, the wheels came off of FTX when it became clear that massive problems lurked below the surface of that group, including, allegedly, criminal activity. Its collapse led to a new set of falling dominoes, with other crypto service providers declaring bankruptcy as well.

There is an unfortunate and strong tendency by many to treat all digital assets as one indistinguishable blob of “crypto.” As a result, all aspects of digital assets can be tainted by problems in any of the sub-sectors of this diverse ecosystem. This has implications for policy and regulation, business and investment choices, and consumer and business acceptance of new ideas in the digital asset space. Thus, there is some pullback from all things crypto and a very distinct toughening of policymaker views on digital assets.

We Expect Continued Innovation in Most Sectors

We see several positive signs of continued investment into digital assets. On the supply side, Electric Capital has reported that monthly active crypto developers grew 5% in 2022 despite the crypto winter. This shows continued interest in the promises of the market’s underlying technology. On the demand side, 91% of institutional investors are interested in investing in tokenized assets, according to a 2022 Celent survey. Prospects vary across subsectors:

Use of stablecoins or tokenized deposits for payments in the “real world.” This is a nascent area but there remain strong reasons to believe that these uses will become substantial over time. There should be little effect from the recent setbacks, assuming solid regulation of stablecoins is put in place, as is in the works. Algorithmic stablecoins demonstrated far more risk than is acceptable for a payments vehicle and will be banned by regulators from any serious role in payments. Stablecoins for payments purposes will be required to be fully backed by traditional financial assets that are highly liquid, highly creditworthy, short-term, and transparent. They may be required to be protected by dedicated capital as well. Tokenized deposits fit more easily into traditional financial and regulatory arrangements but will still need regulatory clarity in order to be fully effective for real world payments.

Central bank digital currencies. CBDCs are another potential tool for payments, with many of the characteristics of stablecoins, but adding the secure backing of central banks. We believe they are coming in most countries, starting with China (where a massive pilot program is now in its fourth year), Europe, and some other pioneers. Thirty-nine countries or currency unions are studying whether to create a CBDC, including the US and UK, according to the Atlantic Council. The setbacks in other parts of digital assets may, in fact, spur this movement rather than retarding it, by increasing the perceived desirability of a public sector alternative, or complement, to private sector digital assets.

Trading and settlement of financial assets. Many institutions are attempting to massively improve the efficiency of financial markets by moving to blockchain solutions. Including a digital currency can allow for near-instantaneous settlement.

Blockchain applications. Some blockchain applications are focused on non-financial issues but need a digital token to make them work optimally. Blockchain also is being explored in a wide variety of use non-financial cases, such as providing 5G coverage for the Internet of Things, managing renewable energy trading, and supporting clinical trials.

Digitally native ecosystems where digital assets improve efficiency. Increasing parts of the economy take place purely digitally, such as the nascent metaverse sector. Digital assets can provide an efficient way of staying inside a purely digital environment, without the complications and costs of switching back and forth between the natively digital activities and traditional financial activities. It is especially valuable to be able to create and exchange ownership rights within the natively digital environment.

DeFi Shows Promise if the Right Safeguards Are Applied

Decentralized finance also suffered from a collapse of activity in 2022. It was a common misconception that DeFi was heavily involved in the many failures of 2022, but that’s due to erroneous claims that Terra’s algorithmic stablecoin was a DeFi project. As the Organisation for Economic Cooperation and Development reports, DeFi protocols did not directly experience any major failures but their liquidation mechanisms and connectivity to the rest of the crypto market likely intensified the turmoil. This is still a very new and rapidly evolving sector, making it difficult to predict its future, but 2022 was a challenging year.

DeFi differs from crypto service providers in that it typically refers to smart contract protocols that may also be governed by distributed autonomous organization (DAOs), so they span both an innovation in process and in governance. Because they are meant as a solution for transacting in the absence of trust, they rely on overcollateralization and self-custodied wallets. This creates an important distinction with centralized finance (CeFi) crypto service providers, but there’s no guarantee that transparency ensures sound business models. While there were no failures, there were significant outflows.

This may be the sub-sector of digital assets with the greatest divergence in views between supporters and opponents. There is great potential for innovative uses of smart contracts and programmability, but also real risks to the financial system and those who use it. On the one hand, there is theoretically huge potential for efficiency gains from substituting automated systems for the cumbersome legacy processes and human-centric approaches used in traditional finance. On the other hand, there are major risks that need to be avoided or mitigated before DeFi could substantially displace traditional finance. The setbacks of 2022 have clearly slowed DeFi growth, but the potential and the risks remain.

Financial institutions and central banks are exploring how to combine the innovative aspects of DeFi with appropriate safeguards. The Oliver Wyman Forum co-authored a report with Singapore’s DBS, Onyx by J.P. Morgan, and Japan’s SBI Digital Assets Holding, where we make the case for Institutional DeFi. This is an approach that combines the power and efficiency of DeFi software protocols with a level of protections and controls that regulators demand and customers expect. This has the potential to unlock significant efficiencies in asset trading and settlement.

New Regulatory Requirements Will Impact Service Providers

The collapse of high-yield products and the FTX debacle will have a transformative impact here, both in themselves and because they highlighted numerous weaknesses in the sector. Policymakers, and many others, were already concerned about the potential conflicts of interest created by commingling a number of activities with core exchange businesses. (This is generally disallowed or severely constrained in traditional finance.)

There are significant concerns about how crypto service providers were using customer funds. Celsius, for example, provided high yields to new clients by taking existing customers’ cryptoassets and using them as collateral against other lending opportunities. Policymakers also are concerned about risk management practices. For example, contagion was exacerbated by concentration of exposures. The opacity of some of the exchanges, and the very limited regulation and supervision under which they operated, was also of deep concern to many. (Other exchanges, it must be noted, operate more transparently and are based in jurisdictions with stronger regulators.) FTX demonstrated that these problems could come together to create massive and unexpected losses.

Policymakers in the major jurisdictions are likely to move quickly, by their standards, to transpose approaches from traditional finance onto new regulations for this sub-sector. Limitations will be placed on which business activities can be combined with exchange activity. Inter-affiliate transactions, such as FTX’s massive loans to its related Alameda hedge fund, will be disallowed or very seriously constrained. Custody activities will be more clearly defined and will be required to include holding client assets separately from that of the service provider. Greater transparency will be required across the board. Finally, basic governance requirements, especially in risk management, will be mandated.

There is a risk that some exchanges may avoid the major jurisdictions, preferring a much lighter touch approach from countries looking to pick up business. However, market forces are likely to make it very difficult for the major exchanges to do this, now that cryptoasset investors and other stakeholders have seen the risks from weak regulation and governance. Further, the major jurisdictions are also likely to put substantial pressure on any countries looking to profit from a lighter touch approach.

Investment and Speculation in Cryptoassets Will Continue

Clearly, this is a sub-sector that was heavily affected by crypto winter and, to a lesser extent, by the FTX debacle. Falls of 75% or more in the price of leading cryptoassets from their peaks raised questions as to whether they are as good an investment or inflation hedge as supporters thought. Reduced interest in owning cryptoassets, and the highlighting of the risks of transacting, made speculation less attractive. This activity won’t go away, but it could be much smaller than at the peak of interest or could take a long time to return to those levels of activity. It could also, though, bounce back faster than most expect.

2022 was a bad year to own cryptoassets. It’s clear now, if it wasn’t before, that prices had been buoyed by a high level of speculative excess, as well as a very favorable interest rate environment. Much, if not all, of that excess has been cleared away. The investment case for cryptoassets as an inflation hedge was considerably weakened by the very large declines in price at a time when inflation, and fear of inflation, was gripping the economy. However, there are still many who remain convinced of the underlying case for cryptoassets as investments, and others who are attracted to speculate on a bounce back. Whatever happens in this regard will also have an impact on the use of stablecoins in cryptoasset transactions, as stablecoins sit between most purchases and sales of cryptoassets. This use is obviously affected by any changes in the volume of transactions.

It is difficult to know what level of investment and speculative interest we will see in 2023 and beyond. There has been some rebound in prices in January, with Bitcoin up nearly 30% this year as of Feb. 13. If prices keep going up, activity levels are likely to pick up as well. On the other hand, cryptoassets do not represent a claim on any underlying asset, such as a piece of a company or someone’s promise to repay a loan or bond, so pricing depends more on sentiment than is generally true of financial assets. This makes it much more difficult to predict.

Beware of Spillover Effects

There are two channels for the problems in the most affected subsectors to spill over to the rest of digital assets. First, there are some direct business links, such as the use of stablecoins to buy and sell cryptoassets, or the funds that some exchanges have invested in other parts of the ecosystem. These direct linkages matter, but do not appear, on the whole, sufficiently large to strongly affect the development of the sectors that are less inherently impacted by the problems of 2022.

Second, and more important, the world’s tendency to lump everything in digital assets together as crypto creates substantial indirect impacts. Policymakers are likely to accelerate the movement to bring digital assets clearly within the regulatory perimeter, and to do so by applying tougher regulatory standards than they would have prior to the recent debacles. Some of this policy action will fail to adequately distinguish between different parts of the digital assets ecosystem. Similarly, funding for digital assets projects of all kinds is likely to be tougher to find going forward than it was when crypto was spinning gold for investors.

Culture and Common Standards Will Be Critical

Many of the blowups for 2022 would never have happened if parts of the digital assets sector, particularly those around cryptoassets, operated under a sounder culture. An acceptance of a high degree of opacity, weak governance structures, and an excessive belief that crypto was so different that time-tested approaches should not apply were all major contributors to the disasters of 2022. Hopefully, the culture will change in direct response to the lessons of 2022. Beyond that, management teams and financial supervisors will need to create structural and behavioral changes to fix cultural weaknesses.

The industry also would benefit from more common standards. A number of experiments are taking place across tokenization of payments and assets, both led by central banks and private institutions. However, the innovations and efficiencies provided by blockchain-inspired technologies rely on digital assets co-existing on the same network. This co-existence is critical to enable automation of business processes and facilitate exchange with fewer intermediaries but depends on networks gaining scale and/or interoperability across networks.

Standardized and well-adopted frameworks will lay a foundation on which new products and services can flourish. The industry as a whole would benefit from alignment on issues ranging from token standards and digital identity verification to asset registries and term sheets. However, it may be challenging to reach consensus, especially given potential differences in cultures and preferences. Banks with a global footprint have experience navigating these differences and should be positioned to lead and propose market-appropriate standards. However, institutions of all sizes should look to participate in this debate.

Final Words

Despite a troubled 2022, most of the digital assets sector will continue to progress, even if not at the breakneck speed that was true prior to crypto winter. Digital assets remain a potentially powerful source of innovation, including when harnessed by the traditional financial sector, as in Institutional DeFi or in wholesale CBDCs. At the same time, there clearly needs to be, and will be, a dramatic transformation in parts of the sector, bringing an end to “Wild West” behavior in some parts of the ecosystem and aligning many activities more closely with the lessons learned over decades and centuries in traditional finance.