Decentralized finance (DeFi), which uses blockchain-based smart contracts to execute a variety of financial services activities, has seized the attention of technology developers, investors, and financial institutions. DeFi protocols have already enabled nascent markets in the crypto-asset industry on public blockchains, such as borrowing and lending as well as decentralized exchanges. Imagine the potential if the technology were to be applied to streamline transactions in foreign exchange, equities, bonds, and other real-world assets. This will require the creation of digital representations, or tokens, of real-world assets to bring them onto the blockchain. The cost savings and new business opportunities of creating a “tokenized” version of real-world assets for transacting through DeFi protocols could be significant for issuers and investors, as well as for financial institutions that can adapt their technology and business models.

That’s an alluring prospect, but many DeFi protocols today are not designed for use in mainstream finance. Firms that wish to apply DeFi in their client offerings must incorporate the same, if not higher, levels of safeguards and security standards that have been developed over decades in the finance industry.

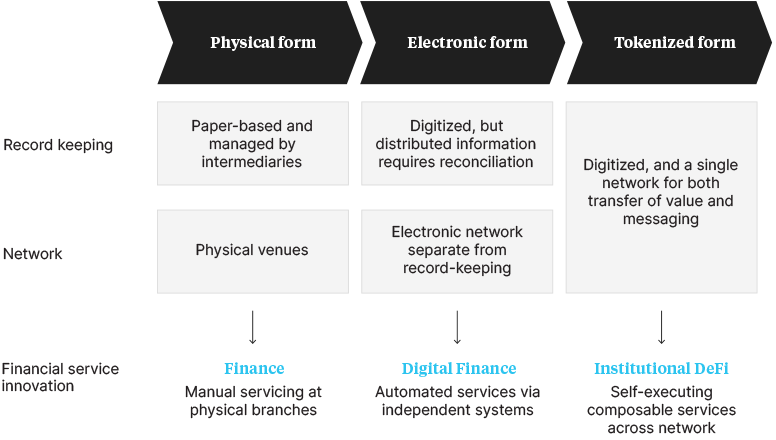

Financial services are built on trust and empowered by information. This trust rests on financial intermediaries who maintain the integrity of records covering ownership, liabilities, conditions, and covenants, among other areas, across a variety of siloed ledgers that are separate from the means they use to communicate. As each intermediary has a different piece of the puzzle, the system requires much post-transaction coordination to reconcile the various ledgers and settle transactions. For example, many securities transactions, particularly cross-border ones, can take anywhere from one to four days to settle.

Distributed ledger technology (DLT), such as blockchain, has the potential to resolve some of those inefficiencies by presenting transactional and ownership information on a single shared ledger. The growing acceptance of tokenization, which creates digital representations of assets such as a stocks and bonds on a blockchain, can extend the benefits of DLT to enable exchange and settlement of a wide range of asset classes. Institutions can generate further efficiency by adopting DeFi protocols, which use software code to automatically execute a range of financial transactions pursuant to preset rules and conditions.

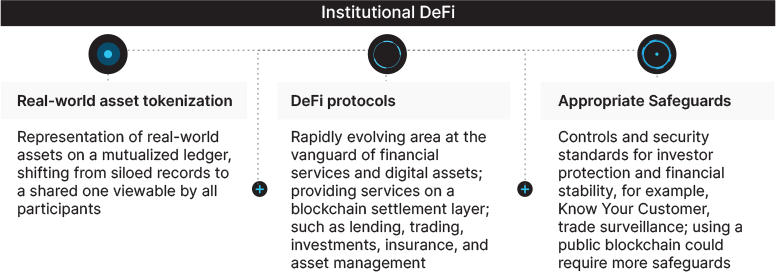

We define Institutional DeFi as the application of DeFi protocols to tokenized real-world assets, combined with appropriate safeguards to ensure financial integrity, regulatory compliance, and customer protection. (It is important to note that in this joint paper we do not refer to Institutional DeFi as institutional players participating in crypto DeFi.) The prize for innovators who hone this model for use in the world’s trillion-dollar finance industry could be substantial.

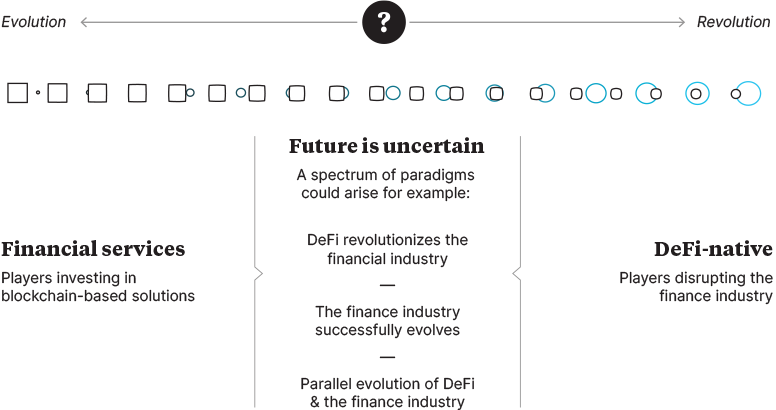

Technology continually evolves and modernizes financial services by creating new ways of executing and recording transactions. Each step in this evolution brings new business opportunities. For example, dematerialization replaced paper certificates with digital ones in the form of electronic book-entries, fostering the rise of electronic payments and trading. That, in turn, made securitization possible, which added value to previously illiquid assets such as mortgages.

Despite recent waves of digitization, trillions of dollars’ worth of real-world assets are recorded in a multiplicity of ledgers that remain separate from messaging networks. This means that financial intermediaries have to record transactions on siloed ledgers and then message each other to reconcile their books and finalize settlement. The need for coordination across ledgers and networks between entities creates inefficiencies that increase costs and risks, lengthen settlement times, and in general add overhead to financial services.

The past few years have witnessed an increased focus on blockchain technology as a potential panacea for resolving these inefficiencies. The promised value of blockchain comes from combining ledgers and networks in a way that allows multiple parties to see the same information, hence greatly reducing the need for reconciliation after a trade or transaction. In addition to creating a shared view of information (transaction balances, ownerships, etc.), blockchains also enable business rules and logic to be executed and viewed with high transparency and in a deterministic manner. For example, lending business logic can be codified transparently in smart contracts, thereby enforcing adherence to rules and automating settlement.

In the process of adopting blockchain technology, financial firms are exploring representing real-world assets as tokens on a blockchain. Such tokenization can reduce settlement risk and decrease settlement times, which typically takes one to two days even for low-risk assets such as G10 government bonds, by enabling so-called “atomic” settlement – the instant exchange of two assets on the condition that assets are simultaneously transferred. No party to a transaction is then left waiting for delivery.

The application of smart contracts in asset tokenization also has delivered a number of benefits, including enhanced and new offerings. For example, J.P. Morgan leverages tokenization to offer intra-day repo solutions for clients on its Onyx Digital Assets platform, and DBS Digital Exchange offers corporates a platform to raise capital through the digitization of their securities and assets, with options to offer smaller denominations.

These tokenization benefits are also welcomed by asset managers, as 70% of institutional investors expressed willingness to pay extra for increased liquidity and faster asset turnover, according to a recent survey conducted by Celent.

Tokenization efforts in the industry are well under way covering both payment instruments and assets, which creates the potential for end-to-end asset exchange on blockchain.

In parallel to industry efforts to develop real-world asset tokenization, the concept of decentralized finance has flowered in the public crypto-asset space. DeFi, as it is popularly known, refers to decentralized applications (DApps), which provide financial services via sophisticated and automated computer code on a blockchain as the settlement layer. These services include payments, lending, trading, investments, insurance, and asset management. DeFi protocols are the code and procedures that govern these applications. These protocols typically operate without centralized intermediaries or institutions, use open-source code, and allow for flexible composability (code or applications can be taken from one protocol/service and plugged into another).

DeFi has rapidly emerged in the past three years and grew more than tenfold to $160 billion in 2021 in terms of total value locked before retreating to stand at a little over $50 billion as of October 2022. DeFi innovations have flourished across various financial ecosystems and attracted billions of dollars of liquidity across decentralized exchanges (such as Curve and Uniswap), lending protocols (such as Aave and Compound), and other DeFi solutions, such as liquidity staking and collateralized debt positions, which lock up collateral in a smart contract in exchange for stablecoins.

Some noteworthy innovations in the DeFi space involve crypto lending/borrowing protocols and decentralized exchanges:

DeFi, as described above, is prevalent in the public blockchain space and applies mostly to transactions in the largely unregulated crypto-asset industry. Yet the logic embedded in DeFi protocols, which are programmable, self-executing business processes, can be applied to interact with any tokenized asset.

Building full-scale financial services that leverage tokenization and programmability could have far-reaching implications for the finance industry. It could generate substantial cost savings, as code dramatically reduces middle- and back-office operations across firms and intermediaries. In the exhibit below we list some notable benefits of DeFi solutions. New business opportunities are also likely to emerge as financial institutions take advantage of the composability of DeFi protocols, packaging multiple DeFi protocols together to offer new solutions. First, however, firms must adapt the DeFi protocols to the regulatory standards of today’s trillion-dollar markets for money, stocks, bonds, and other assets.

Today’s finance industry rests on an array of safeguards that protect investors from fraud and abusive practices, combat financial crime and cyber malfeasance, maintain investor privacy, ensure that industry participants meet certain minimum standards, and provide a mechanism for recourse in case things go wrong. Institutional DeFi will need to incorporate the same, if not higher, level of standards to meet regulatory requirements, create trust, and drive adoption by issuers, investors, and financial institutions.

Here are some of the key safeguards needed to build DeFi-based solutions for institutions:

While Institutional DeFi has potential, financial institutions need to consider areas where tokenization and programmability are most valuable, and tailor DeFi protocols for their purposes accordingly instead of simply reusing what works in the crypto-asset industry.

Institutions interested in exploring Institutional DeFi solutions should start by asking themselves, “why DeFi?” The answer will depend on the commercial viability, adoption feasibility, and competitive advantage of such a solution. Objectives could range from creating new products and reducing data reconciliation tasks, to cutting costs and speeding up settlement times.

Firms also need to consider a number of broader objectives when designing Institutional DeFi solutions. These should include:

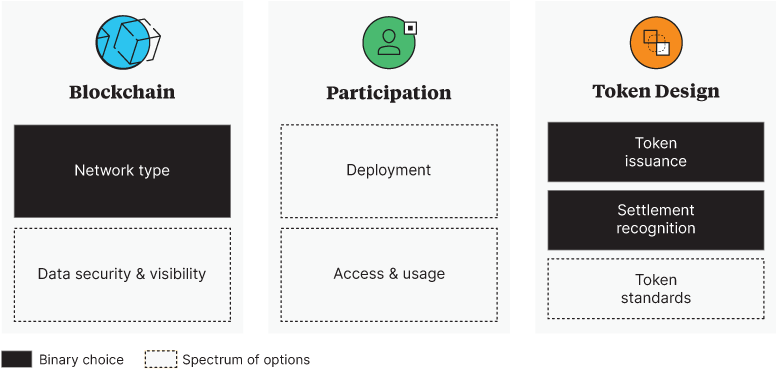

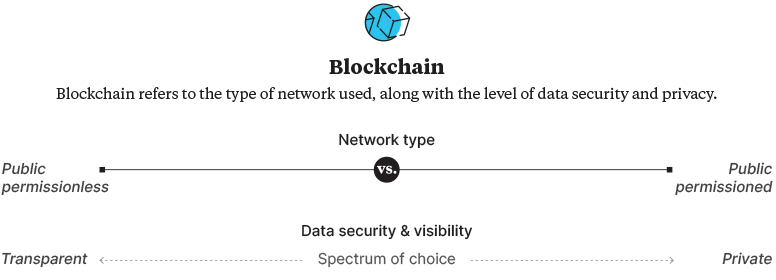

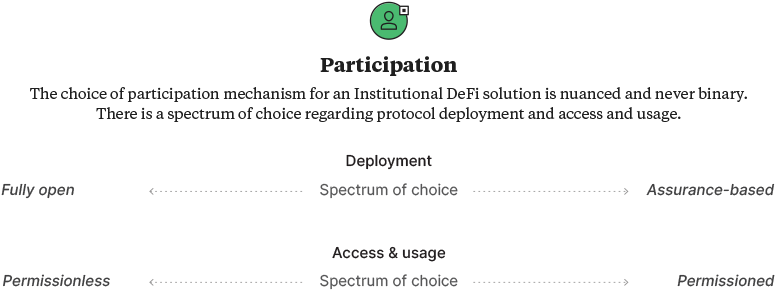

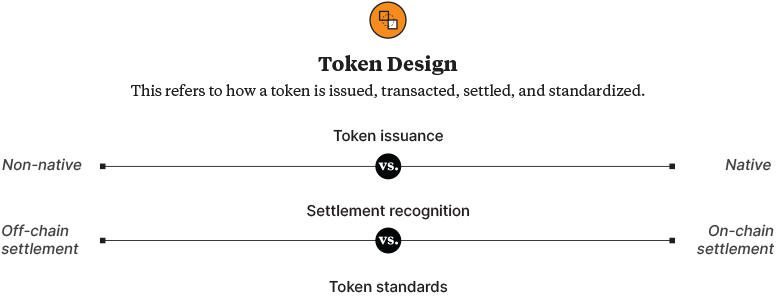

After firms have established their objectives, they need to make choices in three key areas: Blockchain, Participation and Token Design. It is critical that firms weigh the options and their associated trade-offs carefully, as these design choices are paramount in influencing how the offerings achieve their objectives.

Experimentation is crucial to understanding different approaches to Institutional DeFi. Finance industry participants around the world are increasingly conducting pilots and experiments to explore different design objectives and choices.

This report draws on the hands-on experience of the co-authors in running a joint pilot under Singapore’s Project Guardian. The Monetary Authority of Singapore (MAS) launched this collaborative initiative with the financial services industry to explore the economic potential and value-adding use cases of asset tokenization and DeFi. Using a controlled, sandbox environment, it aims to test the feasibility of applying asset tokenization and DeFi protocols, while managing financial stability and integrity.

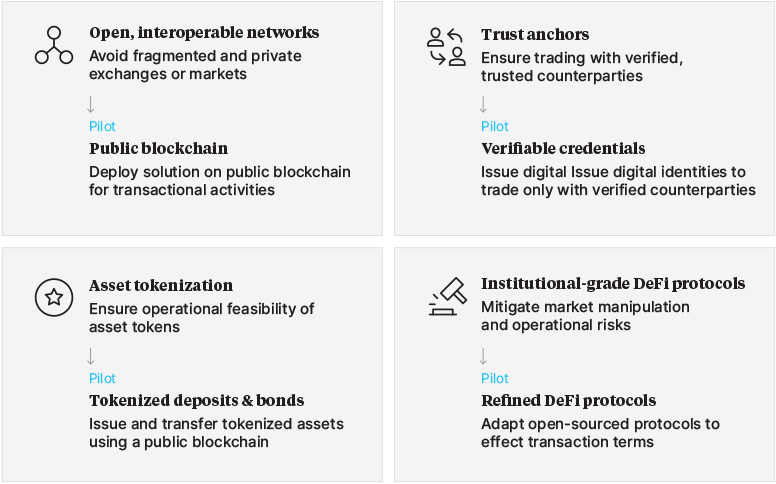

Project Guardian is designed to help MAS build a digital asset ecosystem framework, develop and enhance relevant policies, and provide direction on technology standards. Project Guardian will test the feasibility of applications in asset tokenization and DeFi, while managing risks to financial stability and integrity. The central bank aims to develop and pilot use cases in four main areas:

In the first pilot, our co-authors gained first-hand experience in implementing DeFi solutions in the financial markets, including foreign exchange and government bond markets. This section details the pilot’s business objectives, design choices, and the lessons learned to date.

We are seeing emerging efforts to tap into the value of Institutional DeFi and transform the finance industry by creating new solutions or enhancing existing ones. This process is still in its early days and more work is needed by both individual firms and the broader industry to scale these efforts.

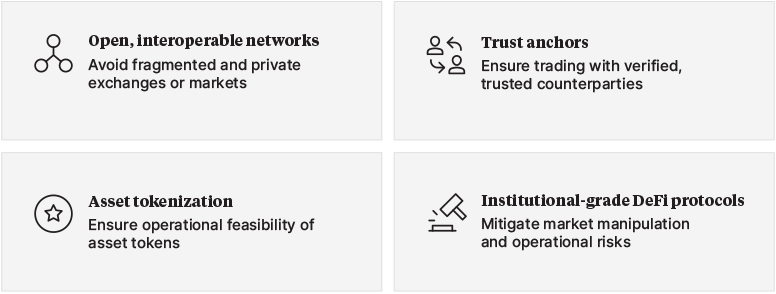

In Sections 2 and 3, we showed how an Institutional DeFi solution can be designed to fit business objectives while navigating industry constraints. But we observed that more could be done at an industry level to lower the threshold for adoption and amplify the value to be unlocked.

Drawing on lessons learned from industry pilots, we see three areas where industry could work together (see exhibit 11). Coordination is essential for widespread adoption of Institutional DeFi. Siloed efforts create the risk of inconsistencies across the industry, potentially stymieing progress and porting existing challenges to this new technology; joint efforts maximize network effects via interoperability and are likely to accelerate adoption.

Industry participants will play different roles toward these ends. We will share perspectives of a general industry framework for roles and responsibilities but be mindful that each business and jurisdiction may require refinement based on its localized specificities.

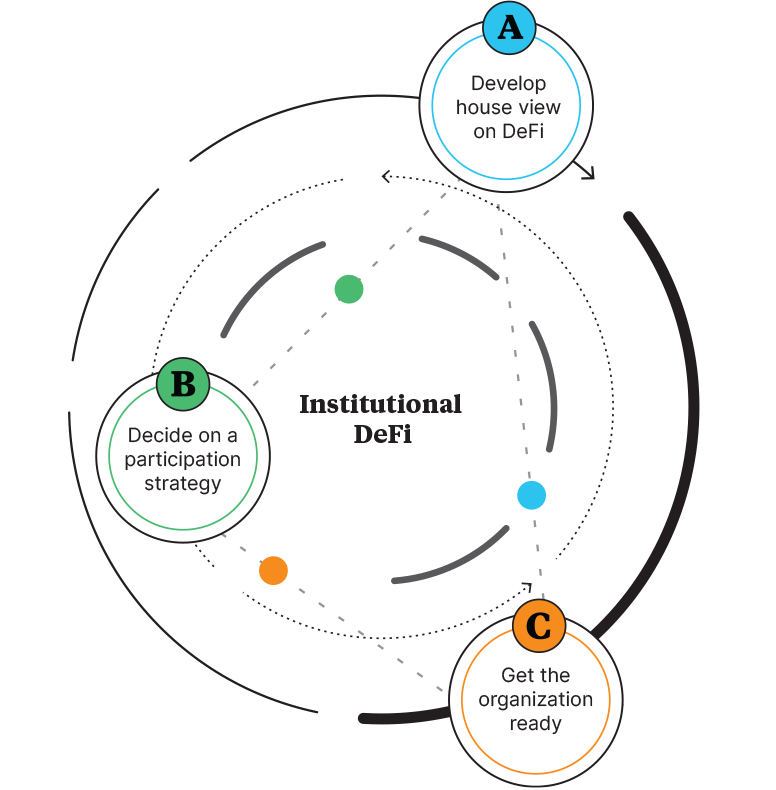

The rapid evolution of blockchain technology and the potential disruption it can bring requires institutions to get ahead of the curve to avoid being left behind. This is not meant to suggest every institution needs to be a leader, but it does require institutions to form a house view on the future of DeFi and the implications for the business, and then define the relevant participation and operating models to fulfill their ambitions. This is not a one-off exercise. It should be iterative given the dynamic nature of blockchain and DeFi protocols.

This joint report would not have been possible without ideas and contributions from numerous members across Oliver Wyman, DBS, Onyx by J.P. Morgan and SBI Digital Asset Holdings, and inputs from the Monetary Authority of Singapore across interviews and workshops. The co-authors would like to express deep gratitude to the following individuals: