By John Romeo

Chief executives today need to respond to short-term disruptions while maintaining a clear vision of their companies’ long-term success. To paraphrase the late behavioral economist Daniel Kahneman, they need to think — and act — both fast and slow.

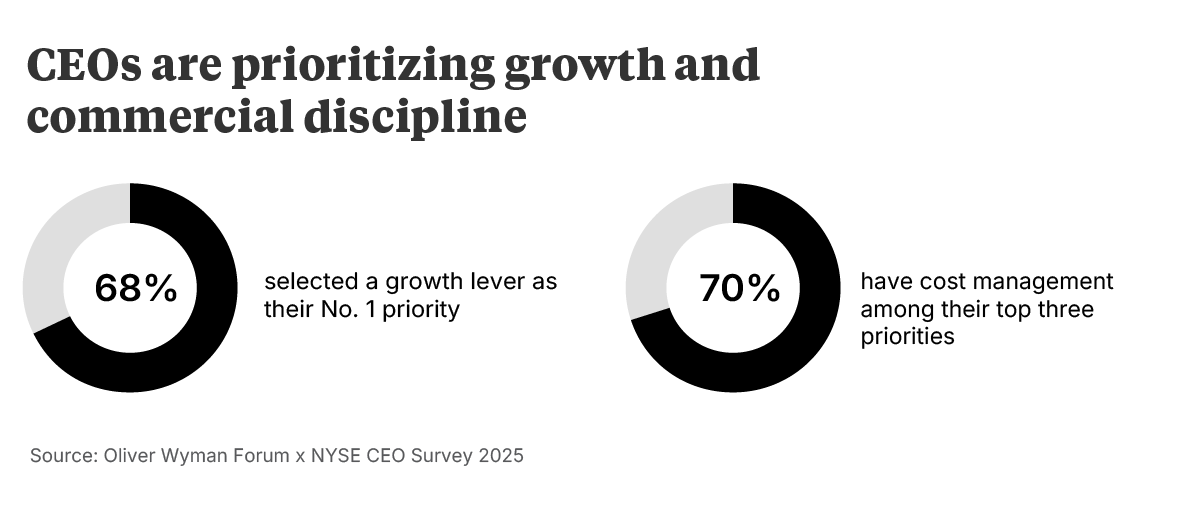

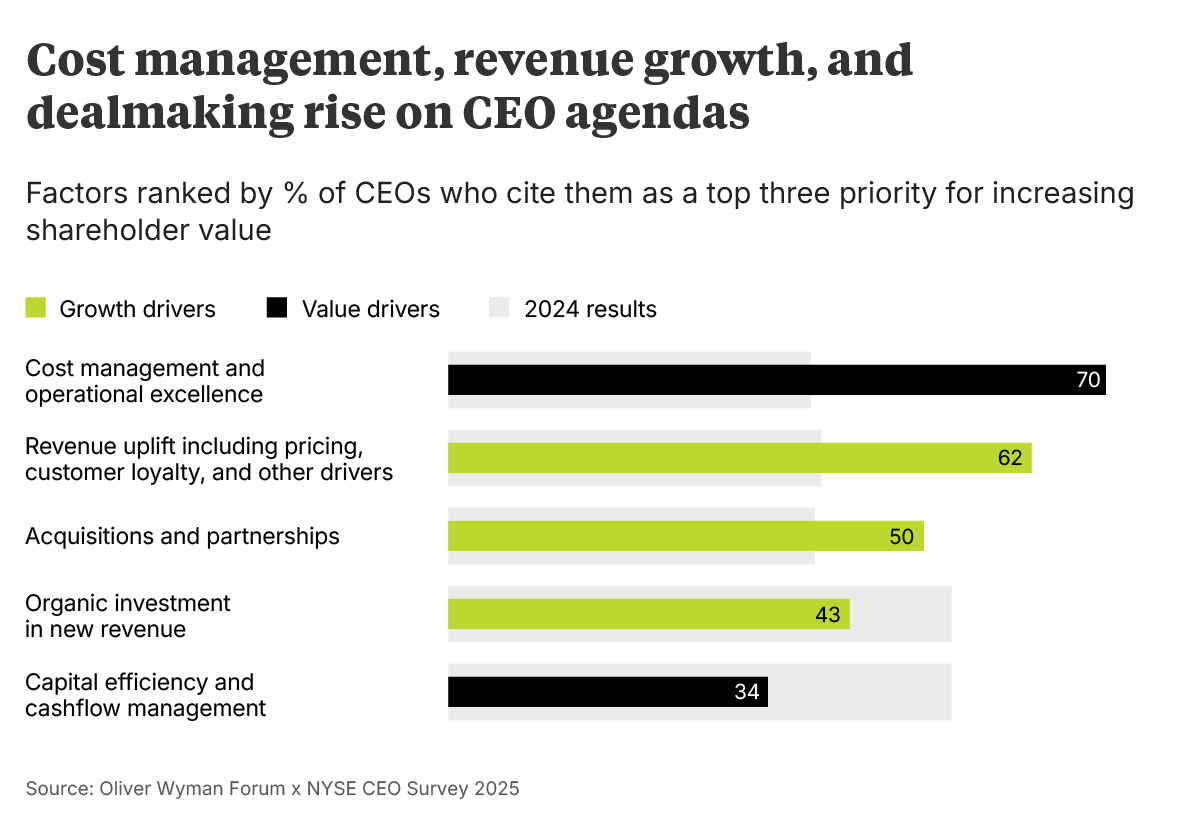

This duality emerges clearly in our latest CEO Agenda 2025, which we examine in detail below. While this year more of the CEOs we surveyed are prioritizing growth initiatives over value drivers, particularly things that can move the needle quickly — 95% are pursuing mergers and acquisitions in the next year or two — 70% cited cost management and operational excellence among their top three priorities, more than any other issue. And most striking, CEOs spend 43% of their time focusing on a planning horizon of a year or less, compared with 26% on the next five or more years.

The implication is clear. To achieve long-term success, business leaders need to act and make bets with less than full conviction. They also should empower managers to experiment and be ready to double down if early results are promising or abandon initiatives that don’t pan out.

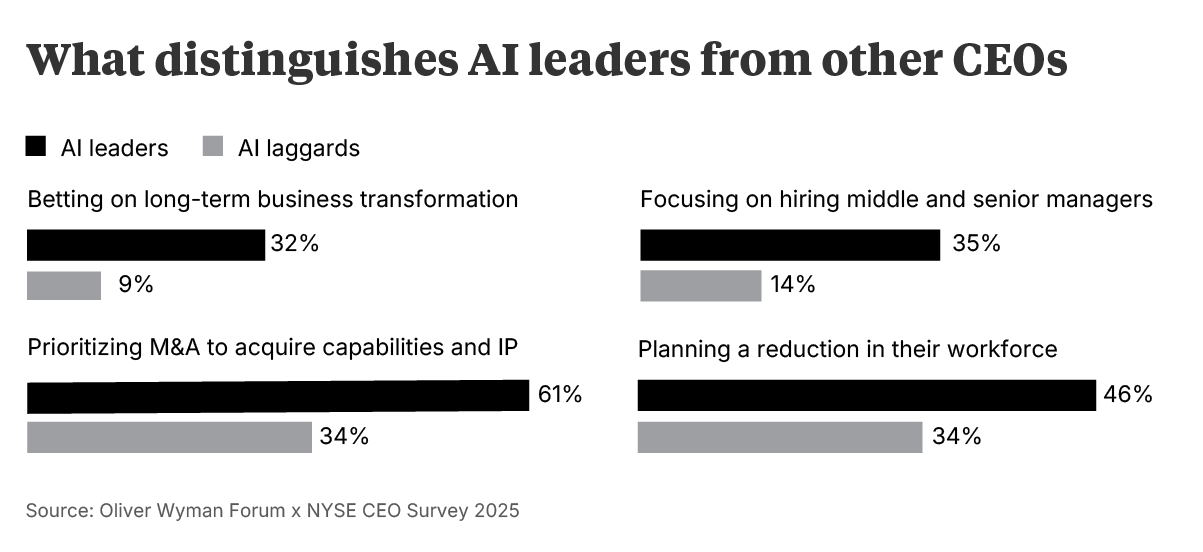

Artificial intelligence (AI) is a case in point. CEOs overwhelmingly regard AI as an opportunity for their business but roughly half cite a lack of proven use cases and issues like cybersecurity and data protection as serious risks. The solution is to lead at the speed of technology, because disruptors aren’t waiting, and stand ready to course-correct when necessary.

Our survey shows a vanguard of CEOs are doing this and pulling ahead of the pack. More than one in six of respondents already are generating double-digit cost savings or revenue gains from the technology. And these AI leaders are much more likely than other CEOs to pursue a fundamental transformation of the business, hire middle and senior managers, and plan M&A to acquire new capabilities and intellectual property.

The ability to stabilize the present while preparing for future opportunities defines effective leadership in 2025. The good news is that this generation of leaders has been trained in resilience in a way we haven’t seen in a long time. That is a tremendous muscle for CEOs to call on in an uncertain world.

John Romeo is CEO of the Oliver Wyman Forum

As the industrial world was reeling from stagflation in 1980 and the free-market order spawned by Margaret Thatcher and Ronald Reagan had yet to take shape, the legendary management guru Peter Drucker told corporate leaders to shut out the noise and focus on what they could control. “The task is to manage what is there and to work to create what could and should be,” he wrote.

Today the world seems on the cusp of another potential regime change, this time to a more fragmented and nationalist economic order, yet Drucker’s advice seems as timely as ever.

Faced with escalating tariffs and market volatility, CEOs are doubling down on both near-term growth initiatives and exerting tighter control over costs, according to the latest survey of leaders of NYSE-listed companies conducted by the Oliver Wyman Forum and the New York Stock Exchange. They are addressing geopolitical shocks, including de-risking their supply chains, while continuing to invest in artificial intelligence (AI), the one area almost every CEO regards as an opportunity for their company.

The message is clear. At a time of great uncertainty, CEOs are determined to control what they can, hedge geopolitical risks that are beyond their reach, and continue to pursue their growth ambitions.

Balancing risk and opportunity

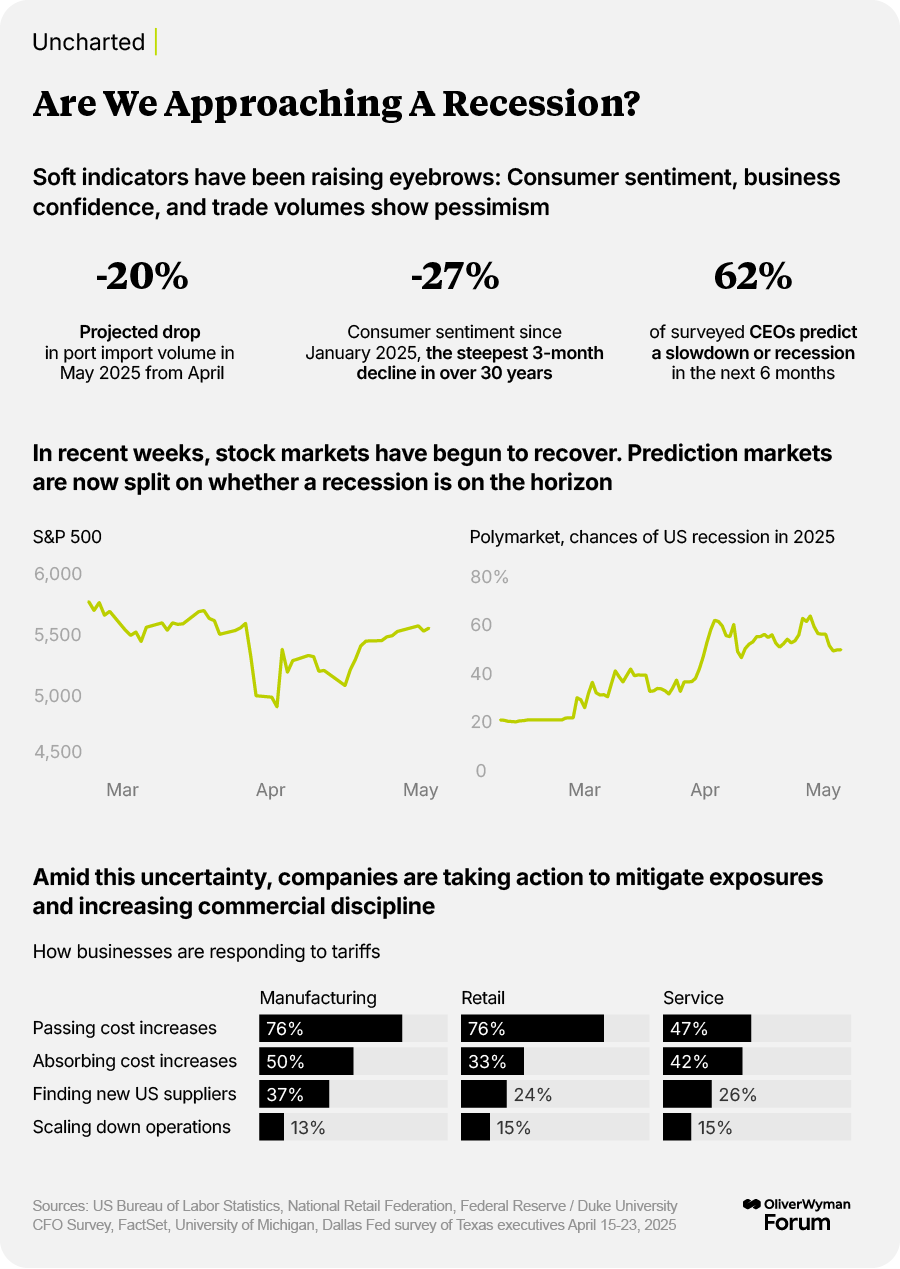

Geopolitical risk, already elevated, has surged even higher on the leadership agenda this year. In our survey of 165 CEOs, which was taken between early March and early April, 89% of respondents rated geopolitics, trade policies, tariffs, and industrial policies as a risk to their company, up 20 percentage points from 2024 — the biggest jump of any risk factor in the survey.

CEOs are adapting their global footprints and supply chains to the new realities but not remaking them for a fundamentally different economic order. A little over half of respondents plan to diversify their supply chains over the next two years but only 13% intend to reshore some operations domestically, while one in three plan to expand geographically through mergers and acquisitions.

Uncertainty and volatility haven’t dampened business leaders’ growth appetite, but it has shortened their horizons and led them to prioritize initiatives that can deliver results quickly. Our survey respondents spend 43% of their planning efforts on time horizons of less than a year, compared with 19% for the next five years.

By far the favorite strategy is revenue uplift through pricing, customer loyalty, and other drivers, cited by 36% of CEOs. An overwhelming 95% of CEOs also plan M&A over the next two years, and 15% cite it as their top strategic priority, up from 9% in 2024. By contrast, organic investment in new revenue streams, which can take years to pay off, was ranked the top priority by 17% of CEOs, down from 29% last year.

The new growth agenda comes with a helping of financial discipline. Fully 70% of CEOs cited cost management as one of their top three priorities for the next two years, but only 15% ranked it No. 1.

Delivering on AI's promise

In a world full of policy-driven uncertainty, nearly every business leader (95%) sees AI as an opportunity to exploit, not a risk. What’s new this year is that view reflects experience, not wishful thinking.

Sixty percent of CEOs said the technology is having some measurable impact in reducing their companies’ costs or increasing revenue, including 17% who are seeing gains of more than 10%. These leaders, predominantly large companies, are three times more likely than other bosses to be betting on long-term business transformation and reinvention to drive shareholder value. They also are more likely to plan workforce reductions while focusing on hiring more middle and senior managers.

Betting on talent and culture

While the labor market has cooled recently and the rise of AI has increased anxiety about job security, CEOs are as focused as ever on their people and workforce culture.

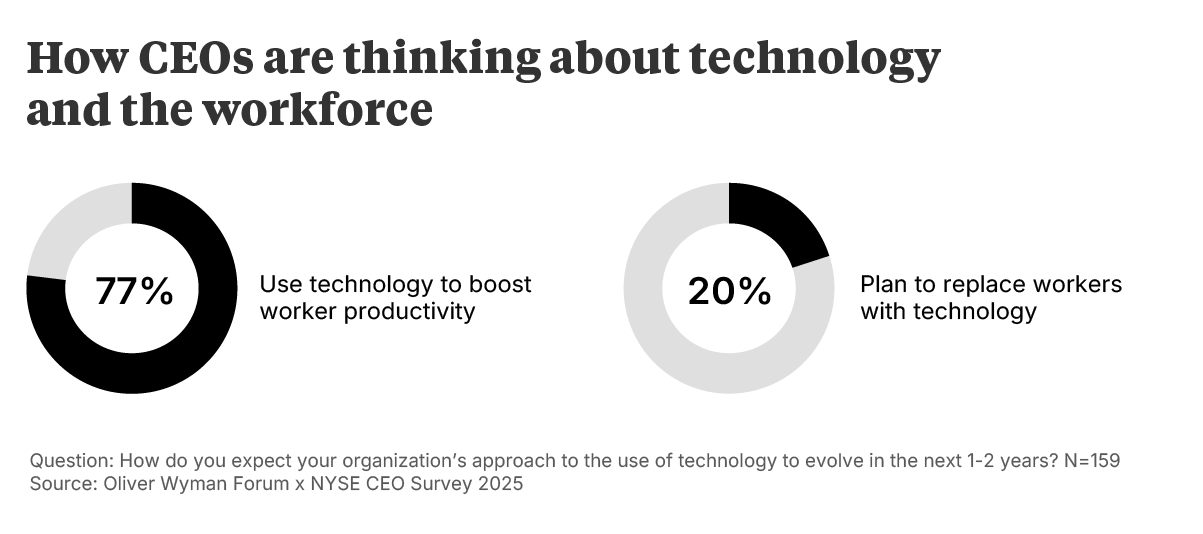

Fully 75% of CEOs cite talent attraction, retention, and workforce development as an opportunity for their business over the next three years. That’s up 25 percentage points from 2024, the biggest increase in perceived opportunity in this year’s survey. And they are far more likely to be focusing on using technology to boost employee productivity than replacing workers.

Our survey is just a snapshot in time, and this year has already shown how rapidly the business environment can change. But leaders aren’t waiting for perfect clarity on the broader geo-economic climate. They are buttressing the resilience of their companies today and planting the seeds of tomorrow’s growth.

A selection of smart reads and podcasts on business, technology, geopolitics, culture, and beyond.

- Why AI Will Not Provide Sustainable Competitive Advantage. Like all technical advances, artificial intelligence (AI) ultimately will become accessible to every company and can’t form the basis of a sustainable competitive advantage, three academic experts argue in MIT Sloan Management Review.

- Can Europe finally fix its capital markets? In the wake of the Draghi report on European competitiveness, some investors believe momentum for reform may finally be gathering, according to the Financial Times.

- The Rise and Fall of Great Power Competition. Donald Trump may want to work with China and Russia in a modern-day version of the 19th century Concert of Europe, but the three countries seem unlikely to muster the collaboration needed to rule today’s complex world, political scientist Stacie E. Goddard contends in Foreign Affairs.

- Baby Is Healed With World’s First Personalized Gene-Editing Treatments. The breakthrough raises hope for people suffering from rare genetic diseases, the New York Times reports.

- Percival Everett’s “James” Wins a Pulitzer. The novelist tells The New Yorker Radio Hour how he gave agency and voice to Jim, the escaped slave and narrator, in his reimagining of Mark Twain’s “Adventures of Huckleberry Finn.”

Every month, we highlight a key piece of data drawn from more than four years of consumer research.