By John Romeo

September always comes with a “back to school” vibe. Colleagues are rested, full of energy and ideas. Reconnecting in person and being reminded why it matters — and what we can achieve when we do — is even more energizing.

This feeling points to something fundamental: the importance of leadership and teaming. In my observation, the best-performing organizations in the world have one thing in common — alignment. From top to bottom, they have clarity of purpose, of the mission, of their values. Everyone knows where the firm is going and how what they are doing fits into the big picture.

Achieving this is a lot harder than it sounds, but we see signs of this thinking in our European CEO survey. Despite swirling clouds of geopolitical tension, economic unpredictability, and rapid technological change, CEOs are not retreating. They’re leaning in, being crystal clear on their role in the market, what they offer to customers, and why and how they do it better than the competition. This isn’t about changing strategy but embracing ambiguity as an opportunity for innovation and strategic renewal — a mindset that will serve them well in the years ahead.

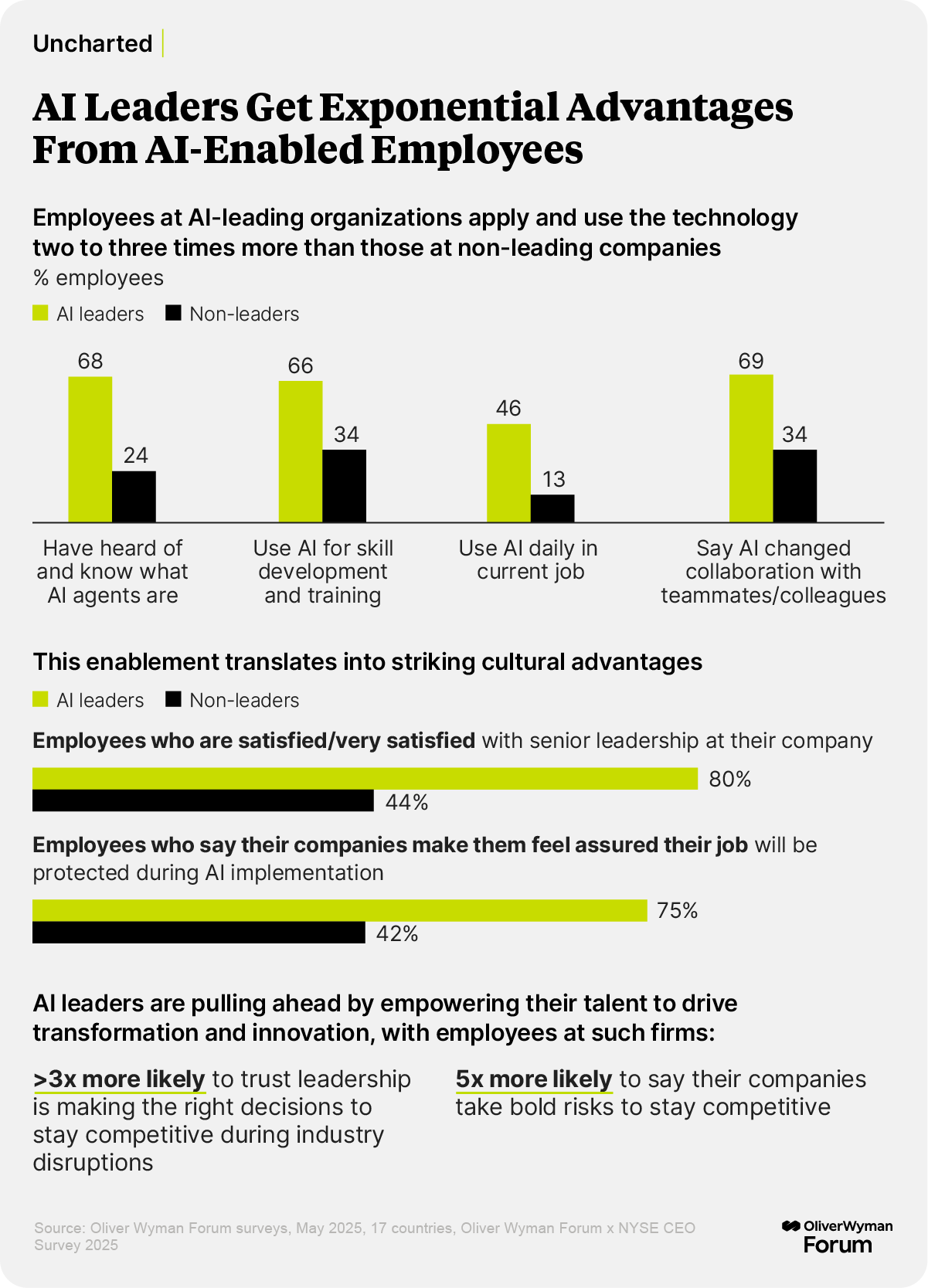

Leaders also are showing a fresh determination to strengthen their teams. They see workforce and culture as key ingredients of long-term success. Even as they cut management layers, most plan to invest in developing employee skills, especially their ability to unlock the potential of artificial intelligence. The key, as always, will be turning those intentions into action and results. Will this be enough to turn around Europe’s moribund productivity? That’s a tall order, but an injection of dynamism would be a start.

This attitude reflects a broader shift in how we think about leadership. It’s never been enough to simply manage risk or optimize for the short term, but today’s best leaders will imagine new futures and build organizations that can adapt and thrive amid constant change. This requires a blend of curiosity, courage, and humility. It means moving further and faster than before, deepening trust and inspiring and empowering teams, not commanding and controlling them.

As you read through the following articles, I encourage you to think about your own approach to uncertainty. How do you balance the need for decisive action with the reality of incomplete information? How do you cultivate resilience not just in your strategy but in your culture and mindset? Where are you prepared to take risks?

In a world where change is the only constant, these questions are more important than ever. I hope this newsletter offers some fresh perspectives, and perhaps a bit of encouragement, as you navigate your own journey.

John Romeo is CEO of the Oliver Wyman Forum

European CEOs aren’t waiting for policymakers to address the region’s lagging growth and increasing challenges from new trade barriers and rising competition.

Eager to grow, they are pursuing mergers, investing in artificial intelligence, and focusing on new opportunities created by an increasingly fragmented global market, according to an Oliver Wyman Forum survey of 77 European chief executives.

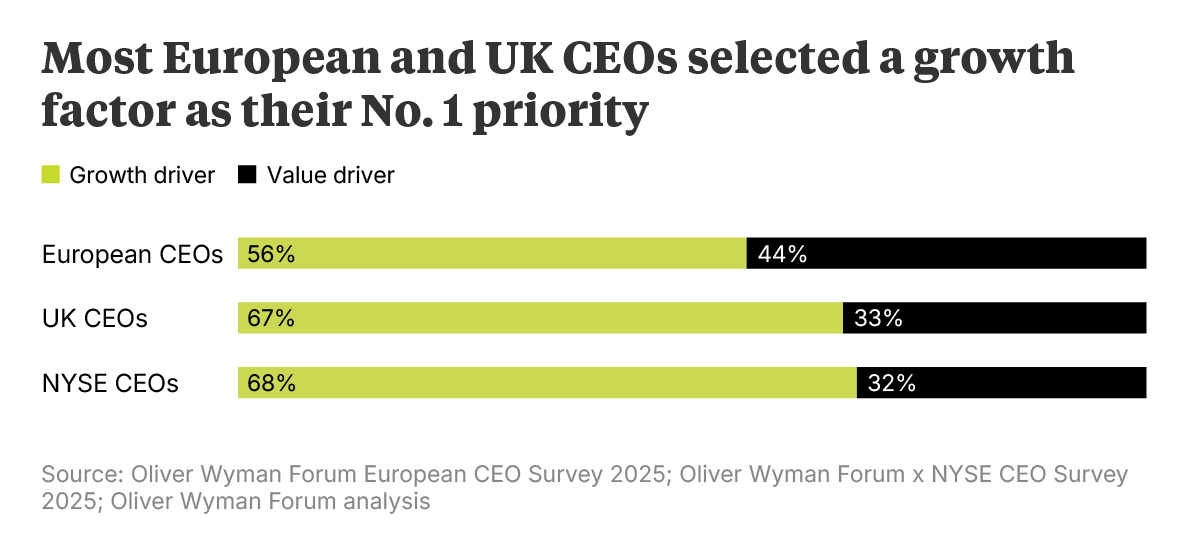

The majority of those CEOs (56%) selected a growth lever as their top priority for increasing shareholder value over the next two years, a number that rose to 67% among CEOs of companies based in the United Kingdom. The most popular levers were revenue uplift through pricing and other mechanisms, organic investment in new revenue streams, and acquisitions and partnerships.

The European growth focus broadly aligns with the approach of CEOs of New York Stock Exchange-listed companies surveyed by the Forum and NYSE earlier this year. It coincides with improving investor sentiment, which saw the Euro Stoxx 600 index outperform the S&P 500 in the first half of this year for the first time since 2022 while the euro and the pound rose sharply against the dollar. And policymakers have begun showing a new willingness to provide stimulus, with Germany easing its strict debt limit to create a €500 billion ($590 billion) fund for infrastructure.

Combining cost discipline with bold bets

Companies aren’t going for broke, especially with European growth continuing to lag American levels at a projected rate of a little over 1% this year. Nearly four in five European CEOs cited cost management among their top three priorities. Nevertheless, their desire to grow through mergers and investing in AI was significant.

Eighty-seven percent of CEOs plan to pursue mergers or acquisitions in the next year or two, a level that rivals the ambition of their NYSE-listed peers. Europeans also express near unanimity about the potential of AI, with 97% seeing business opportunity in the technology. And more than two-thirds rank technology and AI among the top three factors for long-term competitiveness, well ahead of NYSE CEOs.

European leaders are investing in AI with a similar degree of ambition as their NYSE peers across a variety of use cases, from driving operational efficiency and workforce productivity to generating new revenue streams. These efforts are paying off, with 14% of CEOs reporting improvements of more than 10% in cost savings or revenue gains from AI, not far off the 17% share of NYSE CEOs achieving such results. These leaders aim to utilize AI’s potential mainly by investing in skills rather than increasing headcount, with three-quarters of CEOs reporting they were investing in employee development.

Seeing opportunity in geopolitics and sustainability

There are two areas where Europe’s business leaders differ from their NYSE counterparts: geopolitics and sustainability.

Europe is hardly immune to geopolitical risk given growing trade restraints and the conflict in Ukraine, and most CEOs are taking steps such as scenario planning to address the issue. Yet a significant 26% of European CEOs cited geopolitics as an opportunity, more than twice the share of NYSE bosses.

The fragmentation of global markets may create openings for European firms to tap into, such as the drop in European demand for US electric vehicle brands. The region’s continued commitment to multilateral approaches also could enable European firms to step in if suppliers and customers want to diversify away from the United States or China. This could explain why nearly a third of European CEOs plan to pursue cross-border M&A.

European CEOs were twice as likely as their trans-Atlantic peers to cite climate transition as a short-term business opportunity and sustainability as a decisive factor for long-term competitiveness. With the market for green products and services projected to reach $10.3 trillion by 2030, the potential for driving growth is substantial.

With Earth’s average temperature continuing to rise above pre-industrial levels, policymakers and financiers are focusing new attention on an old tool for combatting climate change: putting a price on carbon emissions.

Carbon pricing typically involves a direct tax on greenhouse gas emissions or a cap-and-trade system of emission permits. The European Union adopted the latter type of program in 2005, but carbon pricing never caught on globally as governments turned to measures such as voluntary decarbonization targets, subsidies for renewables, and phasing out coal-fired power plants.

Combining carbon pricing with trade levies

The Group of 30 thinks it’s time for a reassessment. The international non-profit, composed of senior policymakers, financiers, and academics, wants carbon pricing to be used as the primary tool for decarbonizing hard-to-abate sectors like steel, cement, shipping, and aviation. A carbon tax is likely to prompt emissions reductions because fossil fuel-based energy and carbon-based raw materials account for a large share of these firms’ input costs, the group argued in a new report, drafted by project advisor adviser Oliver Wyman.

In the absence of any international agreement on carbon pricing, the report suggests that countries or blocs that do use such schemes follow the EU’s example and implement carbon border adjustment mechanisms, which effectively put a tariff on imports of carbon-intensive goods from countries that don’t. The report also stresses the role carbon dioxide removal credits can play in financing the energy transition.

A quantitative approach to saving nature

Other organizations are focusing on combatting the degradation of the natural environment. More than half of global gross domestic product depends on natural assets like freshwater, minerals, metals, and soil, according to the World Economic Forum, leaving as much as $2.7 trillion in growth at risk over the next five years.

A first step in addressing the threat would be setting quantifiable targets for consuming the planet’s natural capital similar to those established for reductions in carbon emissions. A recent white paper by Oliver Wyman, on behalf of Dutch bank ING, examined the mining and agriculture and food processing sectors, which have sizable impacts on freshwater consumption, land use, and pollution. It suggested banks consider setting targets for the food businesses they finance of reducing their water withdrawals by 1.5% a year in stressed regions and aligning fertilizer use with EU nitrogen limits.

“Aging is always seen as a negative. There's a pensions crisis, a health crisis. That's a weird way of looking at one of the greatest achievements of the 20th century — an increase in life expectancy.”

- Andrew Scott, Director of economics at the Ellison Institute of Technology and author of “The Longevity Imperative,” in conversation with Oliver Wyman Forum Partner Rupal Kantaria.

A selection of smart reads on business, technology, geopolitics, culture, and beyond.

- The Decline Of The West And The Rise Of “The Rest” Will Lead To A New World Order. A new multiplexity is emerging in which no single power dominates but the United States remains a military, financial, and technological leader, China is pre-eminent in development and trade, and the European Union helps regulate trade and environmental threats, according to Amitav Acharya, distinguished professor at American University’s School of International Service.

- Why AI Is Struggling To Discover New Drugs. A decade of efforts to speed drug discovery with artificial intelligence have largely failed. Can generative AI, the new tool in researchers’ kits, change the game?

- Toxic Fumes Are Leaking Into Airplanes, Sickening Crews And Passengers. Since 2010, US regulators have received thousands of reports of passengers and crew getting sick — some suffering brain injuries — when ventilation systems leak airplane fuel into the cabin. Don’t hold your breath waiting for regulatory action.

- The Superyacht, The Billionaire, And A Wildly Improbably Disaster At Sea. A gripping account of the 2024 sinking of UK tech icon Mike Lynch’s Bayesian explains how a vulnerable design and a remarkably sudden and concentrated storm caused the ship to capsize in 10 minutes while a smaller vessel barely 100 meters away suffered minimal damage.

- AI School Is In Session: Two Takes On The Future of Education. Imagine grade school with just two hours of personalized instruction a day, or new university models that abandon the study of long-form texts and seek to “give shape to persons equal to the conditions of freedom.” MacKenzie Price, co-founder of Alpha School, and science historian D. Graham Burnett of Princeton University sit down with The New York Times’ Hard Fork podcast team.

- Chasing Le Carré In Corfu. Editor and author Honor Jones wanders the cricket grounds, back streets, and archives of the Greek island for insight into novelist John Le Carré, who used his father — a con man with ties to Corfu — as inspiration for the protagonist of “The Perfect Spy.”

- Rivals Rub Shoulders In The World Of Competitive Massage. A former nurse’s assistant from Florida, a German therapist who sets his patients’ blankets on fire, and a Ukrainian former hookah bar operator walk into a Copenhagen classroom. Welcome to the World Championship in Massage — no joke!

Every month, we highlight key data points drawn from more than four years of consumer research.