What’s their secret? They share four distinguishing traits.

They deploy AI swiftly and broadly, with an ROI-first discipline. Leading companies have moved beyond pilot projects to implementations with a relentless focus on generating a return on investment (ROI). CEOs of AI leaders are seven times more likely than others to say it’s not too early to assess ROI, and they can show the receipts: One in three leaders reported that more than 20% of revenue already comes from AI-enabled products and services. Nonleaders are still in earlier phases of exploration, with just 34% reporting any revenue gains from AI.

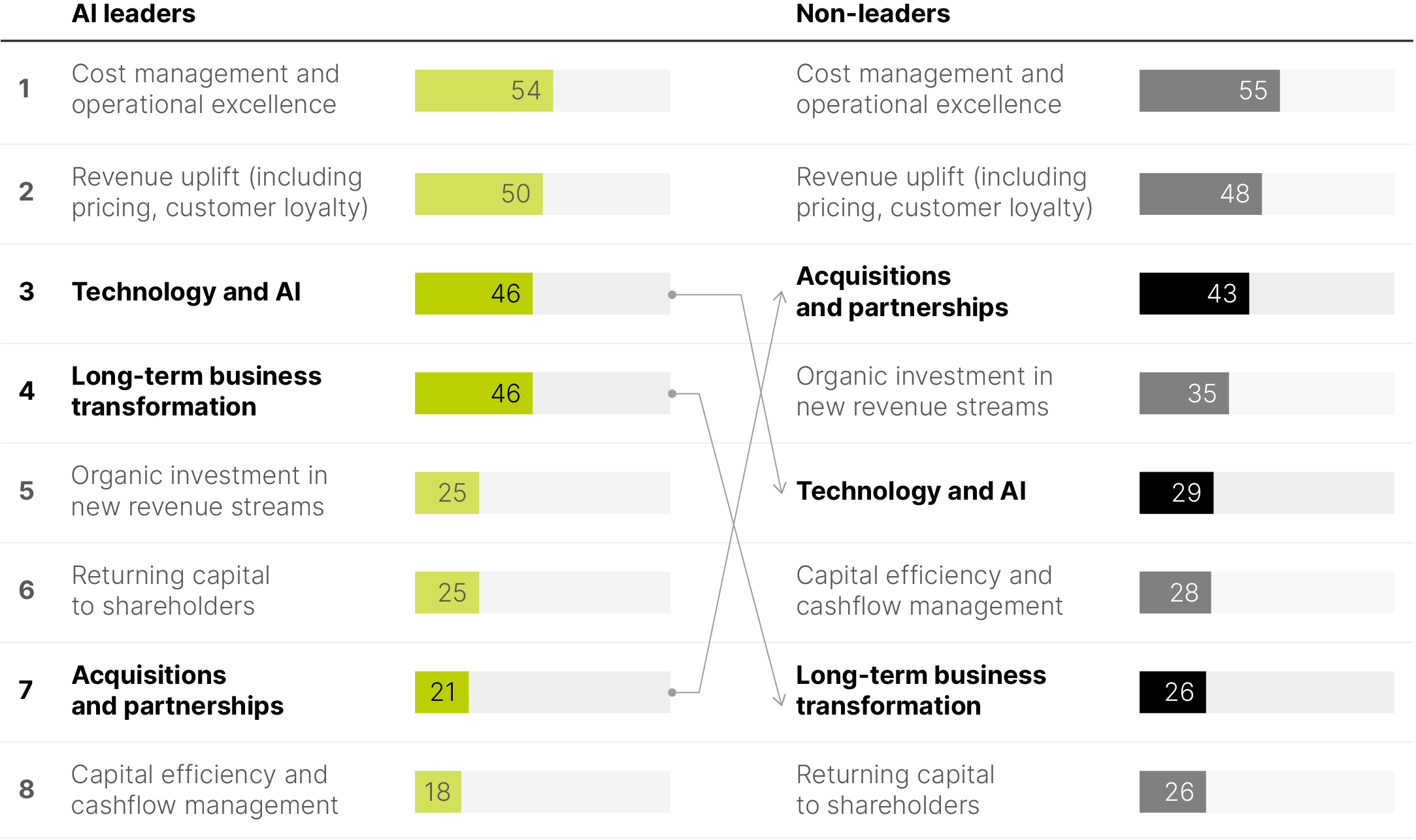

They transform rather than tweak. Leading companies embrace AI as a tool for reinventing the business, not simply generating incremental returns. AI leaders are nearly twice as likely to prioritize long-term business transformation as a route to shareholder value over the next one to two years (non-leaders rank it nearly last), and they favor organic development of AI capabilities — activating employees, growing internal expertise, and nurturing AI-ready cultures over acquiring them through M&A (43% of non-leaders bank on acquisitions and partnerships as a shareholder value levers, compared with 21% of AI leaders).

They seize opportunities in uncertain times. Leading companies see today’s uncertain environment as more of an opportunity than a risk because they have conviction about who their customers are, how to serve them, and why they’re better than competitors. This clarity enables AI leaders to make quick yes-or-no decisions about which opportunities align with their core purpose and which don’t, while others take more time to evaluate multiple options. The most interesting gaps emerge in people and customer domains: Leaders are nearly 30% more likely to see talent and workforce turbulence as an opportunity and more than 40% more likely to treat shifting customer needs as a chance to pull ahead.

They turn employees into force multipliers. Workers who identify their companies as AI leaders are nearly three times as likely as others to believe strongly in their company’s future, twice as likely to be satisfied with senior leadership, and twice as likely to feel job security during AI transitions. Confidence is a transformation accelerator: These workers are more than three times as likely to feel engaged during disruption and five times more likely to say their company takes bold risks to stay competitive.

To be sure, these early patterns could shift, and it isn’t yet clear if today’s leaders will still be out in front tomorrow. But the contrasting approaches show how the same market conditions, technologies, and challenges that constrain some organizations become the very elements that enable others to flourish and potentially transform themselves, like the birds and fishes in the images adorning this report.

In times of profound uncertainty in AI — with questions swirling around artificial general intelligence, AI hallucination, and regulatory frameworks — companies that move first become natural laboratories, offering early evidence of what works and why.

ONE

They deploy AI swiftly and broadly, with an ROI-first discipline

The internet changed our world so dramatically that it’s easy to forget how long it took to make an impact. Tim Berners-Lee proposed the World Wide Web back in 1989. Five years later, Jeff Bezos incorporated what would later become Amazon.com. In 1997, it climbed past $100 million in revenue, but profitability lagged: Amazon didn’t report its first full annual net profit until January 2004, nearly 15 years after the internet was effectively invented.

Today’s AI revolution is unfolding on a compressed timeline. Artificial intelligence is too powerful and developing too rapidly for companies to hold back. So CEOs of AI leaders are investing with purpose — and speed — to explore, prove, and capitalize on more use cases.

Half of these CEOs say one of their biggest concerns about AI is not moving fast enough and being left behind by competitors; only 29% cited too few proven and feasible use cases. The opposite is true of CEOs of non-leading companies. Their biggest concern is too few proven use cases (55%), while only 36% cited the fear of being left behind. This mindset difference shapes strategic priorities: AI leaders are asking “How fast can we scale this?” while others are focusing on “How can we be certain this works?” Both questions matter, but the emphasis reveals different approaches to managing AI uncertainty.

AI leaders’ focused pursuits are delivering real returns early. Roughly four out of five CEOs of AI leaders (79%) say their investments have already met or exceeded expectations for enhancing the firm’s overall ROI, compared with just 28% of CEOs of non-leaders. A more sizable share of non-leaders (48%) say it’s too soon to assess AI’s impact on total ROI.

Digging one layer down, we see 86% of these leaders citing some level of tangible revenue impact, with one in three generating more than 20% of revenue from AI-enabled products and services. By contrast, only 34% of CEOs of non-leaders reported some measurable revenue impact from AI, and none of them exceed 10%. On the cost side the impact is even greater, with over nine in 10 leaders (93%) citing cost impact, and 14% citing greater than 20% cost efficiency, compared with 18% of non-leaders citing tangible cost benefits. The gaps are telling: Leaders are already measuring returns while others are likely still measuring readiness.

These results are impressive, and AI leaders are surprisingly far ahead of the pack. But some of the success owes to individual and tactical productivity gains rather than true enterprise transformation. Most organizations, including many AI leaders, remain constrained by bottlenecks in which humans still touch key workflows, limiting their ability to capture enterprise-level value. A pure ROI play from isolated use cases isn’t how companies ultimately will win in the AI era; that requires the kind of comprehensive business transformation we’ll explore next. Yet reaching even this foundational level is critical, and the gap between leaders and non-leaders suggests how challenging the full transformation journey could be for many.

These early AI successes unfold against a backdrop of intensified pressure for quick, demonstrable results across all business initiatives. Short-term pressure isn’t new. Our recent State Of Our World report showed CEOs across industries racing to prove value quickly. Both AI leaders and non-leaders are laser-focused on near-term delivery, with leaders devoting 79% of their planning to one- to three-year horizons, versus 73% for non-leaders, a marginal difference that shows everyone’s feeling the urgency.

While both groups are seeking short-term wins, AI leaders are aligning today’s initiatives with long-term vision. A striking 71% see technology and AI as the key to long-term competitive success over the next five to 10 years, 58% more likely than non-leaders (45%). In contrast, CEOs of non-leaders ranked financial strength and flexibility as their number one, with 46% saying it’s the top force influencing their long-term competitiveness. The non-leaders’ strategy isn’t without merit. Prioritizing financial resilience offers crucial advantages in an uncertain landscape, including the ability to weather market volatility, pivot when opportunities emerge, and maintain optionality as the AI race unfolds. It’s a more conservative playbook that preserves resources and flexibility for multiple scenarios. But as this chapter reveals, the technology believers are already separating from the pack — turning their focused AI investments into measurable competitive advantages while others hedge their bets.

These patterns offer an early roadmap even as the ultimate competitive landscape remains unclear. In every major technology wave, from social media to smartphones, pioneers who mastered the steepest early learning curves were sometimes overtaken by fast followers able to commercialize more efficiently. Whether today’s leaders maintain their edge or provide stepping stones for others, their approaches reveal valuable lessons about navigating technological uncertainty. The imperative isn’t to mirror their strategies exactly but to extract insights that inform each organization’s unique path forward.

TWO

They transform rather than tweak

Tactical AI implementations can deliver measurable ROI and build organizational confidence, but that’s only the first step in achieving fundamental change. True enterprise-level value, the kind that reshapes entire business models and provides sustainable competitive advantage, is created only through comprehensive efforts to combine technology with new ways of working and developing products and services. This is where AI leaders and non-leaders reveal their most significant strategic differences.

The divergence begins with how leaders prioritize transformation itself and the role technology plays in that process. Nearly half of CEOs of AI leaders (46%) cited long-term business transformation and technology and AI among their top three priorities for creating shareholder value in the next two years. By contrast, only 26% of CEOs of non-leaders ranked business transformation as a top priority and 29% attached a similar importance to tech and AI. Just as notable is how leaders are aligning their short-term efforts with long-term objectives. As we mentioned earlier, 71% of CEOs of AI leaders ranked technology and AI as a force that will have the biggest impact on competitiveness over the next five to 10 years, compared with just 45% of CEOs of non-leaders. It’s the difference between adding smart appliances to an existing kitchen and rewiring the entire house — both involve technology, but only one transforms how the space fundamentally operates.

The build-versus-buy divide is equally telling. CEOs of non-leaders ranked acquisitions and partnerships third as a priority for creating shareholder value, with 43% citing it, while CEOs of AI leaders ranked it a distant seventh (21%). This suggests AI leaders are more confident in their internal capacity to implement the technological edge they need to compete in the AI era.

For their part, AI leaders appear more focused on mobilizing all available resources for transformation. Their CEOs are twice as likely as CEOs of non-leaders to report increased board involvement in engaging external stakeholders like investors, regulators, and policymakers (36% versus 18%). This doubling stands out because it’s the only area where leaders significantly outpace non-leaders in board activation. It suggests a more systematic approach to transformation — one that recognizes success requires both building internal capabilities and managing the external relationships that can enable or constrain AI efforts.

The bottom line: Leaders and non-leaders recognize the importance of AI for competitiveness but are pursuing different strategies to exploit it. AI leaders are placing concentrated wagers on internal transformation and technology capability building, while non-leaders emphasize external partnerships and financial resilience. But AI’s unprecedented pace of development raises a critical question: Will there be time for non-leaders to course-correct, or are we witnessing the early stages of a permanent competitive separation?

Unlike previous technology waves, where fast followers could eventually catch up, AI’s exponential improvement and compounding advantages may be creating a narrower window for strategic pivots. If AI proves fundamentally different from past technology cycles, the risk extends beyond falling behind — it could mean falling so far behind that the gap becomes difficult to bridge.

THREE

They seize opportunities in uncertain times

CEOs of AI leaders consistently view a wider range of business factors as opportunities rather than risks, but their optimism follows a clear pattern. They’re significantly more likely to see upside potential in areas where they can directly influence outcomes, while showing a similar degree of caution as CEOs of non-leaders in areas beyond their influence. This suggests they’re not just more optimistic but potentially more willing to act quickly in areas where their choices matter most for their broader strategic direction.

The clearest example of this pattern revolves around changing customer needs and preferences. Fully 86% of CEOs of AI leaders see opportunity in this aspect of their business, compared with just 60% of CEOs of non-leaders. A similar gap exists in talent and workforce strategy, where almost all CEOs of AI leaders (89%) see opportunity, compared with 70% of CEOs of non-leaders. These domains are undergoing rapid evolution and also are highly responsive to internal decision-making through product innovation, brand positioning, hiring, and capability-building. Leaders appear more confident in their ability to shape outcomes in these areas, treating volatility as a signal to act, not step back.

Even in areas where most see risk, leaders are more likely to spot opportunity. Political volatility, for example, is viewed as a risk by most leaders (71%), yet CEOs of AI leaders are still nearly three times more likely than those of non-leaders to see upside potential (25% versus 9%). In cybersecurity, the gap is fourfold, 21% to 5%. These wide differences suggest AI leaders adopt a dual perspective: They’re more inclined to ask “How could we make this work to our advantage?” alongside the necessary “How do we hedge or protect ourselves?”

Their eagerness to pounce on opportunity isn’t unbridled, though. Consider issues such as regulation, geopolitics, and macroeconomic volatility, where business influence is inherently more limited and outcomes depend on external policy shifts, global dynamics, or market cycles. Only one in 10 CEOs of both AI leaders and non-leaders see opportunity in those domains; the overwhelming majority perceives risk if they regard the issue as relevant to their business.

This opportunity-focused mindset appears to drive more flexible organizational strategies. While most preparedness measures for geopolitical shocks show similar priorities between groups, CEOs of AI leaders are nearly three times more likely to emphasize adjusting workforce strategy by geography (39% versus 14%). This gap suggests that leaders are building organizational agility into their resilience planning, viewing geographic talent distribution not as a defensive hedge but as a way to access global talent pools and operate across time zones.

The evidence suggests AI leaders have mastered a fundamental principle of navigating uncertainty — maximize agency where possible, minimize exposure where it’s not. Their selectiveness in spotting opportunities reflects deep clarity about their customers, capabilities, and competitive position, enabling them to act quickly and confidently in areas they can influence while hedging prudently against forces beyond their control. AI leaders have mastered the ancient sailor’s wisdom: You can’t control the wind, but you can set your sails and choose your destinations accordingly.

FOUR

They turn their employees into force multipliers

Organizations spend millions on AI technology and months planning implementations, only to learn that the critical success factor was hiding in plain sight: their own people. While organizations focus intensely on strategy, technology selection, and implementation timelines, they frequently underestimate the human dimension. Common missteps include rolling out AI tools without adequate training, communicating change through generic company-wide emails rather than meaningful dialogue, and assuming employees will naturally embrace AI without addressing their concerns about job security or relevance. Yet this human element becomes critical as AI directly impacts how people work, learn, and collaborate.

Employee data reveal dramatically different realities between leading and lagging organizations. Through a separate Oliver Wyman Forum global employee survey in 2025, we compared the attitudes of workers who consider their companies to be AI leaders with workers at companies still catching up. The divide plays out dramatically in day-to-day operations: Confident workforces race to join AI pilots, continuously propose process improvements, and eagerly troubleshoot implementations, while uncertain workforces hang back, wait for clear directives, and create friction around changes.

Workers at AI-leading firms are nearly twice as likely to have received formal AI training and to use AI tools for skill development, and are nearly three times more likely to understand AI agents and their applications. More telling is how deeply AI becomes embedded in daily work: Employees at leading firms are also over three times more likely to use AI daily and twice as likely to report that AI has transformed collaboration. The data point to a crucial divide: Some workforces are equipped to drive AI innovation forward while others remain passive recipients of technological change.

The real payoff of being ahead shows up in employee confidence and cultural outcomes. Employees at AI-leading firms are nearly three times more likely to believe strongly in their company’s future and twice as likely to be satisfied with senior leadership. When it comes to views of their direct managers, AI-leader employees are three times more likely to be very satisfied than workers at non-leaders. Further, they’re nearly twice as likely to feel their jobs are secure during AI transitions. This confidence gap creates a self-reinforcing cycle: Engaged employees drive better AI outcomes, which builds more confidence. This creates a talent magnet effect: Employees become advocates for their companies, helping attract like-minded professionals while reducing turnover costs that plague organizations struggling with AI adoption.

This confidence translates into organizational energy that accelerates transformation. Employees at leading firms are over three times more likely to feel engaged during disruption and to believe their leadership consistently makes the right moves to stay competitive during industry disruptions. They’re also five times more likely to say their company takes bold risks to stay competitive. This energy stems from systematic organizational support. Employees who identify their companies as AI leaders are 10 times more likely to say leadership provides clear AI vision and keeps workers informed and three times more likely to say there are formal AI leadership roles.

The competitive implications are profound: Organizations that create confident and AI-capable employees may be building the ultimate strategic asset. These workers aren’t just more productive; they’re becoming organizational multipliers who drive innovation, embrace change, and accelerate transformation from within. By contrast, organizations that fail to create this environment may find themselves caught in a vicious cycle in which employee uncertainty and lack of AI readiness undermines AI initiatives, making future technological adoption even more difficult.

This workforce readiness may explain why AI leaders can afford to bet on internal transformation while others hedge with external partnerships. In an era when competitive advantage increasingly flows from organizational agility and innovation speed, the ability to create a workforce that’s energized, trained, and ready rather than intimidated by AI transformation may determine who wins the next phase of technological change.

Methodology And Sources

The Oliver Wyman Forum conducted a CEO survey in collaboration with the New York Stock Exchange between March 8 and April 7, 2025. The survey was taken by 165 CEOs of NYSE-listed companies. Additionally, Oliver Wyman Forum ran a separate CEO survey in Europe, collecting 67 responses. The results validated our findings, with the comparisons between AI leaders and non-leaders holding very consistently across both datasets.

The survey results are presented as unweighted given the valuable insight of each CEO and hard-to-reach audience. Percentages displayed in exhibits may not sum to 100% due to rounding. The survey was split across topics that are salient for many businesses globally, such as strategy and priorities, managing geopolitical and supply chain volatility, capturing value from AI investments, and optimizing talent and culture.

For this analysis, we defined AI leaders as those CEOs that reported revenue or cost improvement of more than 10% from AI initiatives. Seventeen percent of CEOs of companies with revenue of more than $1 billion reported such gains. Whether these companies have already seen gains or are clearly tracking toward them, they offer critical insight. The focus is not on how many hit specific thresholds — but on how they approach AI: clear strategies, early signals of value, and an understanding that they’re still early in the journey.

In addition to the CEO survey data, we used the Oliver Wyman Forum’s 2025 quarterly employee and consumer general population survey of more than 16,000 people across 17 nations — France, Germany, the United Kingdom, Saudi Arabia, the United Arab Emirates, South Africa, Australia, China (Hong Kong), India, Indonesia, Singapore, Brazil, Canada, Mexico, and the United States — as of March, April, and May 2025. That survey was sourced from a panel of 67 million people worldwide, and to ensure representative distributions our respondent pool generally mirrored the demographics of each country, including age, income, education level, political affiliation, and gender.

Acknowledgements

We will continue to explore AI’s organizational impact as the competitive landscape evolves, tracking how different strategic approaches perform over time. Our aim is not to identify ultimate winners but to build a more nuanced understanding of how organizations can navigate change — even if the final destination is unclear.

Authors

Ana Kreacic, John Romeo, Jad Haddad, Michael Zeltkevic, and Simon Luong.

Contributors

Tom Buerkle, Charlotte Fuller, Kristen Hefferan-Horner, Aoife Hughes, Robert Hunter, Dustin Irwin, Alisha Jha, Dan Kleinman, Gayatri Kotnola, Christina Kyriakides, Nick Liptak, Jilian Mincer, Heather Stern, and Jing Ying Wee.

Art and Design

Neil Campbell, Dani Romo, and Cynthia Pérez.

About The Art

In 2024, the Oliver Wyman Forum used a duck-rabbit illusion on the cover of our first report on artificial intelligence. The classic image challenged leaders to rethink AI not just as a matter of perspective but of perception. It sparked debate, invited double takes, and opened the door to deeper conversations.

We chose M.C. Escher’s “Sky and Water I” for this report because it reflects the ambiguity, emergence, and transformation of AI. At first glance, it appears seamless. Look again, and the fish gradually become birds.

Escher created this piece in 1938, during a time of global uncertainty. His work blends art, mathematics, and illusion, challenging how we perceive structure and change. “Sky and Water I” is part of a broader body of work that responded to chaos with clarity and to structure with paradox. It offered visual metaphors for complex systems in flux.

That makes it especially relevant today. How companies use AI is evolving and quickly. Some leaders are flying ahead while others are treading water.

We also chose this work to make a point. In a world flooded with AI-generated content, craft still matters. We tested whether AI could convincingly replicate Escher’s image. It couldn’t. The precision, intent, and flavor of the original remained out of reach. By licensing a historic work, we are also reinforcing values: respect for intellectual property and design that is intentional rather than disposable. Escher’s image doesn’t just decorate the cover, it frames the report. And like the best ideas, it invites us to look twice and think deeper.

M.C. Escher's “Sky and Water I” © 2025 The M.C. Escher Company-The Netherlands. All rights reserved. www.mcescher.com