A year after the artist known as Beeple stunned the art world with the $69.9 million sale of a non-fungible token, many people are wondering what the fuss over NFTs was all about. Sales of these art works have plunged this year even as leading consumer brands, musicians, and sports stars flooded the market with digital images to promote their brands.

For many artists, though, the NFT revolution is only just beginning. They are eager to explore how blockchain technology can inspire new creative approaches, forge deeper connections with collectors, give artists a greater cut of the value of their work, and write a new chapter in the never-ending debate on the question, what is art. And these artists, ranging from digital natives to traditional creators just discovering blockchain, believe this new medium will make a lasting impact on the way art is created and appreciated, just as photography did more than 150 years ago.

Jose Davila, a Mexican sculptor and painter, first heard about NFTs when Mike Winkelmann, aka Beeple, fetched a then-record price for his digital collage, “Everydays: The First 5000 Days,” at auction at Christie’s. “What got my attention was not the price but the birth of an artistic medium that the digital age has created,” he says. “Somehow art is always an expression of its time.”

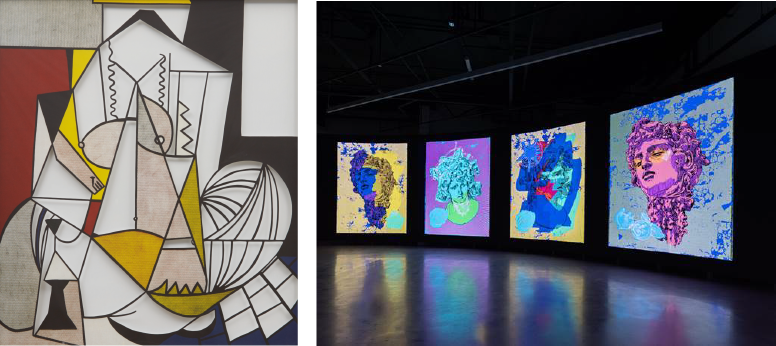

Jose Davila's "Untitled (Femme d'Alger)", courtesy of Koenig Galerie (left); Mieke Marple's Medusa Collection at the Artists Who Code exhibition at Vellum LA."

In June, Davila sold his first NFT, a video of a painting he did in Cubist style but inspired by Eugene Delacroix’s “Femmes d'Alger dans leur appartement,” with elements of the painting cut out and restored as the video runs. Borrowing from historical art figures and mixing styles to enter a new medium felt like a natural first step, but Davila is eager to go further and explore more conceptual approaches. “In the NFT world, we’re still in diapers,” says Davila. “I’m just curious to see how it will develop.”

The Crypto Winter Effect

The developmental path already is proving bumpy. NFTs have been caught in the downdraft of the broader plunge in the cryptocurrency market, which has lost almost two thirds of its value – nearly $2 trillion – since peaking in November 2021. Ether, the currency in which most NFTs are denominated, has lost nearly 70% of its value over that period, while the average NFT price plunged by 77% between April and June.

Much of the speculation has focused on the collectibles sector, which includes so-called profile pictures, or PFPs, like the Bored Ape Yacht Club and CryptoPunks. Collectibles account for roughly three quarters of NFT trading volume, or $6.1 billion in the first quarter, according to data specialist nonfungible.com. These tend to be corporate or collective projects, but the sector also has spawned plenty of scams such as rug pulls, in which developers raise money on the promise of a hot new collection then disappear with the funds without finishing, or even starting, the project.

The art sector accounts for less than 10% of trading activity, or $673 million in the first quarter. It typically features one-of-a-kind works or collections from individual artists. People like Mieke Marple.

A Los Angeles gallery owner turned painter, she started making images of her work and selling them as NFTs in early 2021. That attracted the attention of a collector who pulled her into a benefit auction alongside seven other artists, one of whom turned out to be Beeple. As Marple puts it, “I had a lot of luck.”

Creating With Code

She was quick to embrace the new medium. Inspired by groundbreaking artists like Refik Anadol, Marple is using computers to make so-called generative art, one of the hottest areas of the NFT market. For a recent Medusa collection, she painted the mythological Gorgon with snake hair, then used a computer algorithm to randomly select different colors for the hair, face, background, and other features to create 2,500 different digital works. Some may scoff at using computers to generate art, but much the same was said of cameras in the early days of photography. “In terms of authenticity, the intention behind making the art matters a lot,” she says.

Technology also helps Marple reach a wider audience. Her Medusas have a floor price of 0.08 ETH on OpenSea, or just under $100, a fraction of the $6,000 and up her paintings tend to fetch. That’s important considering that Gen Zers are the most avid fans of NFTs, according to the Oliver Wyman Forum's Global Consumer Sentiment Survey. Americans and French aged 18 to 24 are particularly strong adopters, being more likely to invest in NFTs than stocks.

Xin Liu embodies the intersection of art and technology. The Chinese-American artist boasts an engineering degree from Tsinghua University in Beijing and master’s degrees from the Rhode Island School of Design and the Massachusetts Institute of Technology. She has parlayed that background into roles as Arts Curator of the MIT Media Lab Space Exploration Initiative and artist in residence at the SETI Institute, which seeks to detect intelligent life in the universe.

Space is an ongoing inspiration for Liu, who filmed a performance of herself moving like a spider in zero gravity during a 2017 parabolic flight. Then when COVID forced her into lockdown in 2020, she discovered she could tap radio signals from decommissioned weather satellites. She used them to create images of mountainous regions of the Earth, then minted the images as NFTs along with the radio frequencies and transmission metadata.

Xin likes the way NFTs can build communities between creators and the fans who collect or admire their work. Equally important is the way blockchain can verify the authenticity of an artwork and enable artists to benefit from the sale – and resale – of NFTs of their work. “It’s a strength of a digital work to be copied and shared freely, but how do we compensate the creators? NFTs create new opportunities,” she says.

Many artists welcome the fact that NFTs put the transactional side of the business front and center, rather than something mediated discreetly by gallery owners. And for the most part they are taking the recent market drop in stride. NFTs aren’t going away, and a less frenzied atmosphere opens up a little time and space to be creative and explore the medium’s potential.

“This is the first time technology is really coming into the traditional art world and upending things,” says Marple. “I don’t know if the world of NFTs is inherently better or worse than the world we’re in, but I do think it’s the future.”

2014

– Year that “Quantum,” a colorful pulsating digital image considered to be the first non-fungible token, was created by artist Kevin McCoy. He sold it for $1.47 million in a June 2021 auction at Sotheby’s. Eight months later McCoy was sued by a Canadian holding company claiming it held the rights to the NFT.

Over $37 billion

– Amount that collectors have spent on NFT marketplaces in the first four months of 2022, almost equaling the volume for all of 2021.

28,983

– Number of collectors who bought units in “Merge," a work featuring spherical images by the digital artist Pak that could grow in size and merge depending on the number of units purchased. The 48-hour sale in December 2021 went for a total of $91.8 million, a record for a living artist and the highest price ever for an NFT if it’s considered a single artwork.

The Web3 metaverse presents an opportunity to fix some of the well-known problems of today’s internet, including data mining and market concentration. It embodies a new, decentralized framework using blockchain technology to integrate virtual worlds with new types of money and assets, including cryptocurrencies and nonfungible tokens (NFTs). This may offer more opportunities for creators and users alike and give them a greater share of the benefits of these virtual worlds, according to a new paper from the Oliver Wyman Forum’s Future of Money initiative.

This alluring vision enabled companies related to the metaverse to raise over $10 billion in 2021, but fulfilling that vision will require fresh thinking from executives and policymakers. Most NFT owners say they have experienced at least one scam, such as investing in a project that turned out to be fake, according to one recent survey. And three quarters of people in 10 countries say they are unwilling to pay to participate in the metaverse, according to the Forum’s Global Consumer Sentiment survey.

Interoperability will be critical. Gaming and social platforms employ distinctive graphics and rules to attract users and provide incentives, such as rewards for playing games, limits on virtual land to support values, and controls over the issuance and use of platforms’ cryptocurrencies. For people to move freely among various metaverse worlds – and take their NFTs, avatars, and digital currencies with them – developers will need to agree on common standards of interoperability.

Integrity and security also will be critical. Should the property rights and financial regulations that prevail in the analog world be applied or adapted to the metaverse? What about identity verification and consumer protection? Which governments or agencies will have jurisdiction, and how will disputes be resolved? Modern economies rely on a complex array of standards, practices, and rules to drive good behavior and build confidence. Policymakers and executives need to construct similar frameworks for a thriving metaverse.