Life keeps coming at us faster. Consider that the past year saw ChatGPT attract 100 million users in record time — only for its corporate creator to nearly implode a few months later. Or that the price of Bitcoin more than doubled even as the US justice system toppled two leaders of the crypto economy, FTX’s Sam Bankman-Fried and Changpeng Zhao of Binance. It seems as if the only thing we haven’t seen is the recession many predicted.

The one thing business leaders can count on in 2024, it seems, is accelerating change across multiple dimensions — technological, geopolitical, economic, and social. These times demand agile leadership that can adapt quickly to disruption from the likes of generative artificial intelligence (AI) and asset tokenization. They also need to strengthen the resilience of supply chains amid rising geopolitical uncertainty, keeping in mind that nearly half the world’s population will go to the polls in 2024, including in the United States, India, Indonesia, and Taiwan, and that conflicts in Ukraine and Gaza could escalate. Against that backdrop, “ordinary” business tasks such as retaining employees might seem less critical — but the advent of generative AI is rapidly changing the talent game as well.

Here's what else to expect in 2024.

Gen AI goes mainstream

A year after the public release of ChatGPT turned the technology world on its head, generative AI will start to make the leap from corporate curiosity to mainstream tech tool. Expect companies in 2024 to shift from cautiously testing the new technology to more rapidly rolling out production-ready use cases that can help employees do routine tasks much faster and brainstorm new ideas.

More teething problems are inevitable, like the backlash against some media companies when their use of AI to produce content was exposed. Many firms will look to develop guardrails around generative AI to avoid faulty outputs or the leak of sensitive data, and to ramp up employee training to use the technology safely.

Healthcare will adopt a leader’s mindset to Gen AI

Like many industries, healthcare is buzzing with excitement over generative AI. Life sciences companies see it as a potential game-changer for accelerating drug discovery, and health systems are harnessing it to drive more personalized patient care. But as they look to embrace these tools in 2024, the successful healthcare firms will be those that think strategically about how they deploy generative AI rather than rushing to the latest shiny object.

Healthcare leaders must adopt a business leader mindset. That means establishing a set of outcomes and key performance indicators they want to hit. Then they can decide which solution to deploy and how. By embedding innovation into their planning process, leaders can successfully navigate the challenges of introducing new technologies and drive meaningful business outcomes.

Countries Will Look To Tech For A Climate Accelerant

The world is making progress in slowing the growth of greenhouse gas emissions, but that’s far short of the dramatic reductions needed to limit global warming. At the just-concluded COP28 climate conference in Dubai, governments for the first time called for “transitioning away from fossil fuels,” set a target of tripling renewable energy capacity by 2030, and committed to slashing methane emissions. Yet the conference also heard that the rise in global temperatures is already bumping up against the Paris target of 1.5 degree Celsius, and atmospheric greenhouse gas levels continue to increase.

Those trends will generate new efforts to develop technological fixes to accelerate progress in 2024 and beyond. Expect more initiatives to capture carbon dioxide directly from the atmosphere, like two projects the US government recently agreed to fund, as well as efforts to develop innovative new nuclear energy capacity and potentially nuclear fusion. And look for a greater focus on public-private partnerships and funding arrangements to generate the risk capital to develop these technologies. The world needs an everything strategy, and robust public policy actions that back up commitments, to scale climate solutions.

New Silk Road drives economic rebalancing

Governments and companies in Asia and the Middle East will deepen their trade and investment ties in 2024, turning the New Silk Road into a powerful motor of global economic activity. Trade between the two regions has grown 70% in the past five years, seven times faster than the rise in global trade over that period. It’s not just oil and manufactured goods; activity is also picking up in renewable energy and mobility, fueled by sovereign wealth funds that have the resources and appetite to place big, long-term bets.

The two regions are strengthening ties at a time when globalization is under threat elsewhere. Asia is home to two of the world’s leading regional free trade agreements, and Middle Eastern countries are negotiating bilateral agreements with Asia. The central bank digital currency project between China, Hong Kong, Thailand, and the United Arab Emirates is one of many underway to improve the efficiency of cross-border payments.

Economic rebalancing also is occurring among Silk Road countries themselves. As China’s economy has slowed, Southeast Asia, India, and countries of the Gulf Cooperation Council now account for 33% of the overall region’s growth, up from 25% between 2005 and 2015. CEOs are taking notice as the growth baton is passed.

Blockchain innovation will intensify in finance

Innovation in digital money and assets will continue apace in 2024, notwithstanding the woes of crypto exchanges like the failed FTX and Binance, which pleaded guilty to violating US anti-money-laundering laws. Crypto native players are improving their capacity to handle transactions at scale and work interoperably with other blockchains, while expectations that US authorities will approve Bitcoin exchange-traded funds have boosted cryptocurrency prices. Meanwhile, major banks will increasingly use distributed ledger technologies to provide faster payment services and to tokenize bank deposits, money market funds, and other assets.

One development to watch will be the creation of a so-called layer 1 blockchain to facilitate cross-border trading of tokenized assets by JP Morgan, BNY Mellon, Development Bank of Singapore, and Japan’s MUFG Bank, working in collaboration with the Monetary Authority of Singapore. The Singaporean central bank also is overseeing five other pilot tests of blockchain-based asset tokenization with a variety of major banks and asset managers.

Shared mobility goes big or goes home

The time of burning cash is over for shared mobility services. Firms offering ride-hailing, car-sharing, and other mobility services will need to turn profitable or face the prospect of bankruptcy in 2024 as the easy money that flooded the sector dries up.

Lower up-front costs make shared mobility an attractive option for people who cannot afford to buy a car. Combining shared mobility with public transit can further reduce transport expenses for commuters. But affordability is key to the shared mobility proposition, which limits the ability of service providers to raise prices. To get out of the red and into the black, these services must scale up volume and increase the range of mobility services they provide. That holds the key to achieving a level of affordability that will keep drawing consumers.

It’s more important than ever for urban mobility to focus on the fundamentals. Cities that offer affordable and efficient mobility with simple essentials — like more cycling lanes and extensive rail and bus networks — can regain their pre-pandemic vitality and buffer against intensifying heatwaves and high living costs that threaten how and why people travel.

Cities like Helsinki, which tops the Oliver Wyman Forum’s 2023 Urban Mobility Readiness Index. The Finnish capital boasts car-free zones, dense electric vehicle charging and cycling infrastructures, and an expanding public transit network that offers a ticket of roughly $3 to ride on any mode of transport.

Invest In Transit To Counter Economic Pressures

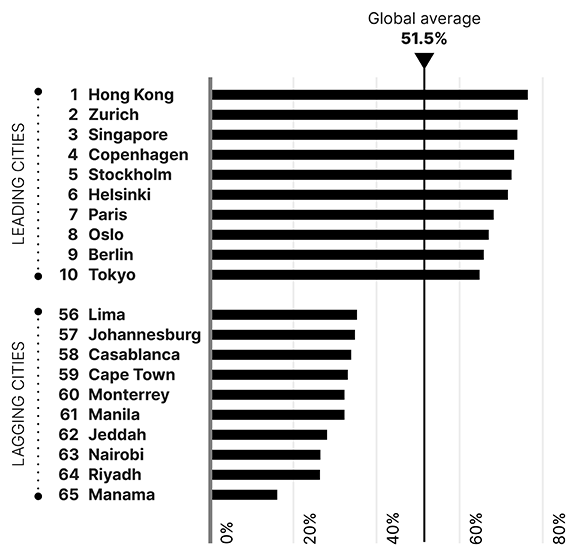

A crucial component for leading cities is a strong mass transit system. It is the most efficient way to enable large numbers of people to get around urban areas, but ridership has not returned to pre-pandemic levels for many cities in the index.

A healthy public transit system can pay rich dividends for cities. Every $1 billion invested in public transport generates economic returns five times as great and creates 50,000 jobs, according to C40, a coalition of 96 cities that advocates for climate action. Hong Kong tops our Public Transit sub-index because of its continued investment in a system that accounts for an impressive 71% of all distance traveled within the city.

Many transit providers need that investment. The American Public Transit Association forecasts a fiscal cliff for most large agencies in the next five years, while a European Union study notes significant loss in post-pandemic revenues. And with nearly half of consumers citing affordability and accessibility as the most important factors when choosing how to travel, according to an Oliver Wyman Forum survey, it’s vital that cities be resolute in lowering costs.

Some governments are proactive about this. Berlin and Munich, for example, benefit from Germany’s new Deutschland-Ticket, which lets commuters use all local mass transit for roughly $52 a month. Seoul, similarly, plans to release a mass transit pass in 2024 that would allow riders to use all subway and bus lines and the city’s bike-sharing service. Boston, meanwhile, is exploring flexible transit fares based on income levels.

As global pressures stress livelihoods and the climate, cities must future-proof their attractiveness as places to live and work. Affordable and accessible mobility networks are just the ticket to ensuring cities’ continued vitality.

Efficiency And Affordability Define The Top Public Transit Systems

Source: The Oliver Wyman Forum and the University of California, Berkeley

The new year is bound to contain surprises, but whatever happens, the Oliver Wyman Forum will be there. We wish you a happy holiday and look forward to providing fresh research, insights, and opportunities to convene in 2024 as we work together to solve the world’s toughest problems. Happy New Year!

In case you missed them, here are a few highlights from 2023.

- Evolution Of Airports – Travel Trends In The Next 30 Years

- What Business Needs To Know About The Generation Changing Everything

- Four Visions For The Future Of Digital Money

- The Urban Mobility Readiness Index

- Why Building Green Mobility Requires An Innovative Attitude

- The Path Forward For Digital Assets And Crypto In 2023

- Singapore Seeks To Drive Growth With Sustainable Mobility

- How Urban Mobility Can Help Cities Limit Climate Change

- Inside The Competition For Big Money

- Representation Matters: Women Political Leaders