The climate crisis supposedly sits higher than ever on the corporate agenda, but concrete actions haven’t matched the public pledges to reduce carbon emissions. It’s time to close the gap.

Roughly half of European companies tracked by climate disclosure group CDP say they have transition plans to meet the Paris Agreement’s goal of limiting global warming to 1.5 degrees Celsius by 2050. But fewer than 5% of them show how they will deliver on those commitments. Many lack detailed implementation strategies, haven’t aligned their spending and revenue with decarbonization targets, or don’t fully engage their supply chains in climate action, according to a new report from Oliver Wyman and CDP.

That’s not good enough. The latest United Nations climate change report shows that urgent action is needed if we hope to meet the Paris goal. To make real progress, companies must articulate the business case for sustainability — showing stakeholders how today’s actions can secure tomorrow’s profits. That will involve three key elements.

Shift the executive mindset

Companies must meld sustainability into their cultures and decisions rather than treat it like a box to check on climate financial disclosures or social responsibility reports.

Viewing key business decisions through a climate lens can change the way executives think and act. Neste, a Finnish producer of renewable diesel and sustainable aviation fuel cited in the latest Oliver Wyman-CDP report, has overhauled its investment framework with explicit climate criteria, including emissions and biodiversity impacts. Neste also factors an internal carbon price — one that hedges on the side of higher-than-expected prices — in investment calculations and business case evaluations.

Peering through that climate lens also can reveal new growth opportunities. Enel, an Italian electricity company, is making sustainability a key pillar of its strategy with a plan to generate 75% of its electricity from renewables by 2025 and phase out fossil fuel use by 2027. Enel also plans to invest about $40 billion from 2023–2025, with 90% of funds supporting electricity generation and power grids.

Enel is expanding its range of renewable power services to electrify other sectors that need decarbonizing, like transportation. Enel plans to install 1.4 million electric vehicle charging points by 2025.

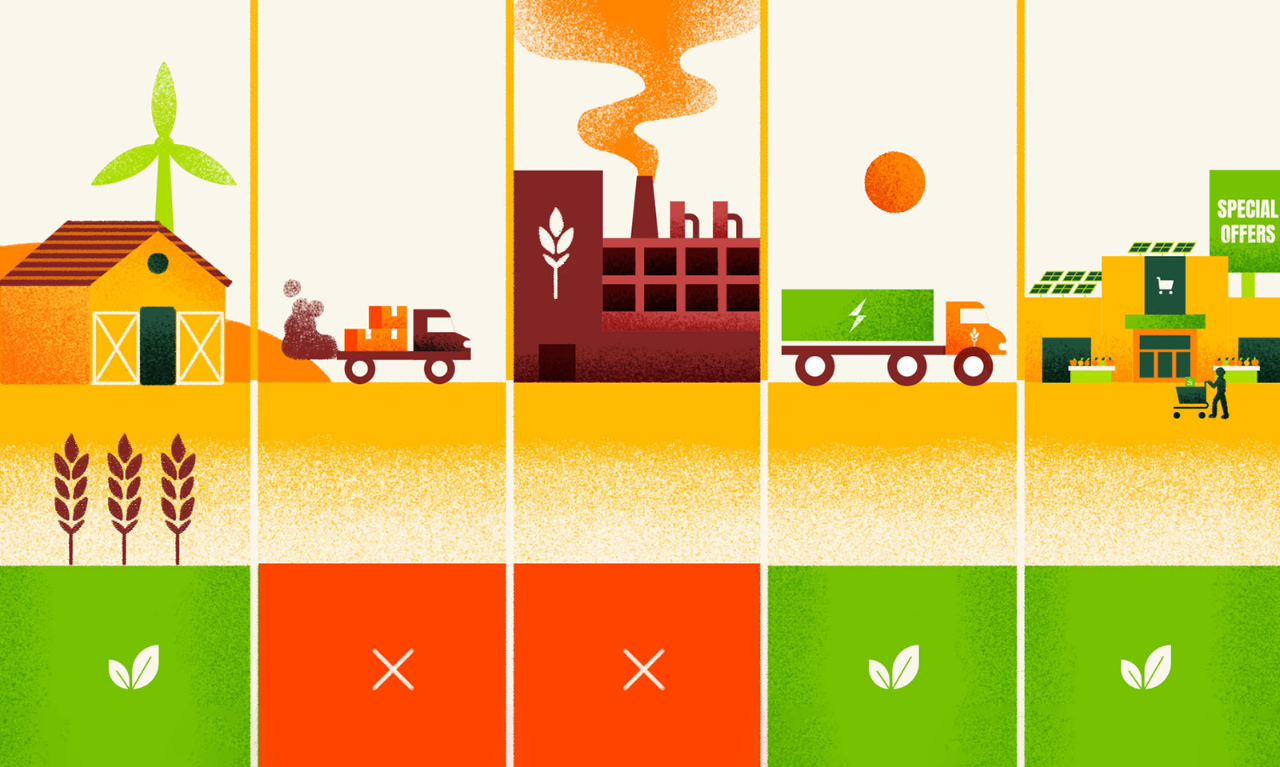

Put your value chain under the microscope

Executives must take their suppliers’ carbon footprints seriously. Emissions that occur in the value chain, known as Scope 3 emissions, account for 78% of a business’s emissions on average. A construction company’s Scope 3 emissions, for example, could come from suppliers’ production of cement, glass, and timber.

Business leaders should learn from others whose businesses depend on an eco-friendly supply chain, like grocery retailers. Some are bringing new suppliers on board, demanding that they adopt farming methods that prevent adverse effects like deforestation, set emissions targets with them, and measure those targets through regular, structured data exchanges. Carrefour, a global food retailer that has 98% of its overall emissions in its value chain, requires its top 100 suppliers to have science-based targets by 2026 and has an alert process to identify farms suspected of illegal deforestation.

Other industries can replicate this kind of shift. Luxury fashion company Louis Vuitton, for example, is moving its leather supply chains out of high-risk environments like the Amazon and working with farmers to monitor their soil carbon levels.

Plan for the sticks and carrots

CEOs may be tempted to defer climate action in favor of a wait-and-see approach, but that only increases the risk that they will be forced to act by regulation or their own consumers. And those with high Scope 3 emissions will pay the price from more expensive carbon pricing legislation if they don’t act now.

Executives would do well to be proactive in working with governments to get ahead of incoming regulation. The US Environmental Protection Agency recently proposed new limits on greenhouse gas emissions, with the aim of ensuring that electric vehicles comprise up to two-thirds of new passenger vehicles sold by 2032. Elsewhere, the European Commission has proposed a directive that would require businesses in the European Union to examine their supply chains and identify and prevent any environment-related negative effects. The proposal, currently being negotiated among EU member states, also would require companies with more than 500 employees and $160 million in net global profit to have climate transition plans.

Legislation isn’t the only threat looming for businesses that don’t act. Executives should heed Gen Zers’ demands for climate-friendly products if they don’t want to lose out on this cohort’s growing purchasing power. Nearly half of young consumers between the ages of 18 and 25 say they would pay extra for greener products, compared with 37% of older generations, according to research from the Oliver Wyman Forum.

Appealing to Gen Zers also can help firms attract them as employees. More than a third of US and UK Gen Zers say they want more professional opportunities to help fight climate change, compared with just over a quarter of other generations. And they’re 50% more likely to want employers to include climate in their mission statements. If employers aren’t active about climate, they may lose the young, savvy talent they need.

Business leaders have come a long way toward accepting the need for a commercially smart transition plan. But most are still far from making sustainability business as usual, with appropriate metrics and objectives. The sooner they act, the better prepared their companies will be on many fronts.