The dream of a cryptocurrency-led financial revolution creating vast wealth and opportunity has taken plenty of hits over the past two years, most recently with the fraud conviction of Sam Bankman-Fried over the collapse of his FTX crypto exchange. Yet monetary innovation continues apace, powered by technology like blockchain, which underpins Bitcoin and countless crypto tokens.

Global banks are creating tokenized versions of bonds, bank deposits, and other assets to provide faster, cheaper services. Central banks are developing digital monies, with India expanding its pilot test of a digital rupee and the European Central Bank launching preparatory work toward a potential digital euro. And while investment has slowed, venture capital firms still poured nearly $2 billion into crypto and blockchain firms in the third quarter, according to Galaxy Digital.

The story of money in all its forms is being rewritten by the day, and the implications for the financial system are only starting to come into view. The range of potential outcomes is vast.

To provide a taste of what may lie ahead, the Oliver Wyman Forum recently published an adventure novel, “Quest For The Token Of Fortune,” that lets readers navigate the possibilities for themselves. So relax, sit back, and imagine …

Your Quest Begins

You are a management trainee on a bank’s foreign-exchange desk learning about how money is created and exchanged. Crypto has appealed to you since you were young because you’ve always wanted to make an impact on the world.

One day a close friend from college asks if you’d like to participate in her new side venture, ShoeDAO, a decentralized autonomous organization that facilitates the reselling of high-end sneakers. ShoeDAO uses blockchain to increase transparency and democratize decision-making, with members using the venture’s own cryptocurrency, ShoeToken, to vote and share in any profits from rising sneaker prices.

As a sneakerhead, you join enthusiastically but soon realize that members need bank accounts in fiat currencies like the dollar or euro to buy and sell ShoeTokens. You suggest that ShoeDAO make it easier for investors to participate by issuing a stablecoin, a private currency designed to maintain its value against a benchmark asset. That requires you to make your first big decision:

• Should you recommend a stablecoin backed by the local fiat currency?

• Or should it be backed by a basket of pricey, well-known sneakers?

The Options Multiply

If you choose the first option, the stablecoin may prove wildly successful, earning you a full-time job expanding ShoeDAO into new areas of activity and facing progressively bigger choices, such as whether to accept a bank’s acquisition offer or steer the venture toward a decentralized future in Web3. If you recommend a sneaker-backed stablecoin, you may find that a star athlete’s public critique of your stablecoin basket’s most valuable sneaker tanks the token, invites prosecution by securities regulators, and leaves you to blog your way back to respectability.

You can read our online version of the adventure novel and make your own choices. You will hit many decision points along your journey: Should you fight prosecution or reach a settlement? Accept a job offer from a larger crypto venture or join the central bank’s digital currency team? Work to promote common industry standards on tokenization or move fast and break things?

Ultimately, your choices will lead to one of four futures that our Future of Money initiative considers plausible: Traditional financial institutions successfully evolve by embracing new technology; new digital intermediaries quickly assume market leadership; a radically different system develops based on open, universal networks; central banks take on a bigger financial role with digital currencies.

As with any startup, of course, there’s always the risk of hitting a dead end. So choose carefully!

Many of the world’s largest companies have committed to reach net zero carbon emissions by 2050. But global greenhouse gas emissions keep growing, and time is running out if we want to halve them by 2030 to limit global warming to 1.5 degrees Celsius.

Companies often start the journey because it’s “the right thing to do,” but real success requires them to design decarbonization plans that align their business and climate goals, according to a new report by Oliver Wyman and the Climate Group.

The report, the third in a series, found that while reducing emissions is important, companies need to embrace “creative destruction” to drive the necessary transformation.

Businesses need to keep building and finding new opportunities to reach the scale necessary to meet climate goals. They need to change their operating models and grow the share of low-carbon solutions they offer. Some companies already have discovered natural opportunities. One company, for example, is reducing its Scope 3 emissions, which come from suppliers and other sources not own by the company, by rebalancing the food it serves clients and introducing “low carbon meals.”

Business leaders also need to think differently about risk, uncertainty, and the capabilities they will need in the future. They need to anticipate regulation, avoid stranded assets, and use arguments based on competitive differentiation. And they can’t do this alone. Business needs the support of their investors, policymakers, and other players to succeed.

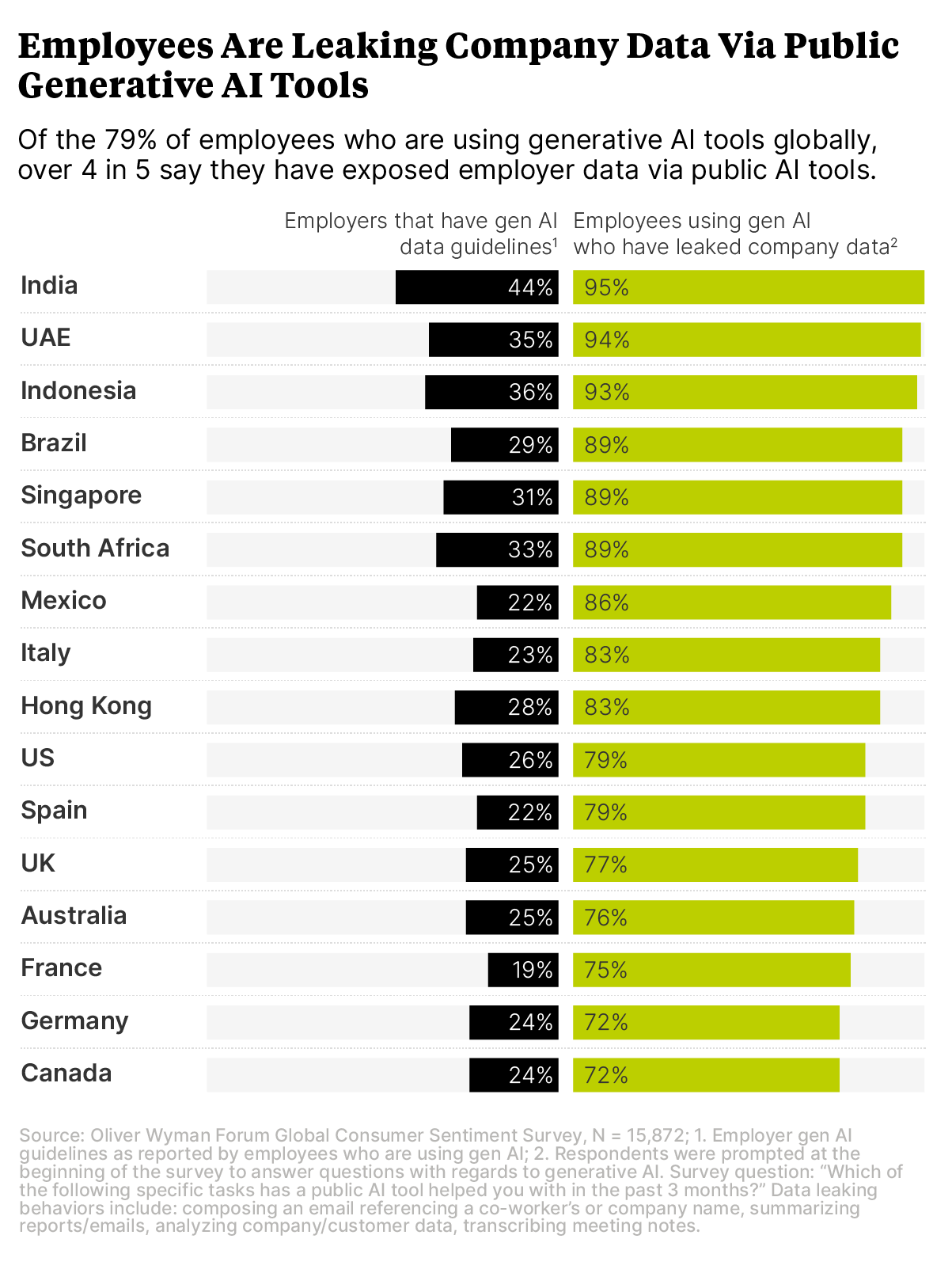

Every month, we highlight a key piece of data drawn from more than two years' worth of consumer research.